Overview

Introduction

Less than three years ago, with very low growth and stubbornly high unemployment, the Government chose to invest in strengthening the middle class and growing our economy rather than implement austerity policies including spending cuts or tax increases.

While austerity can come from fiscal necessity, it should not turn into a rigid ideology about deficits that sees any investment as bad spending. That approach has failed around the world, and in Canada.

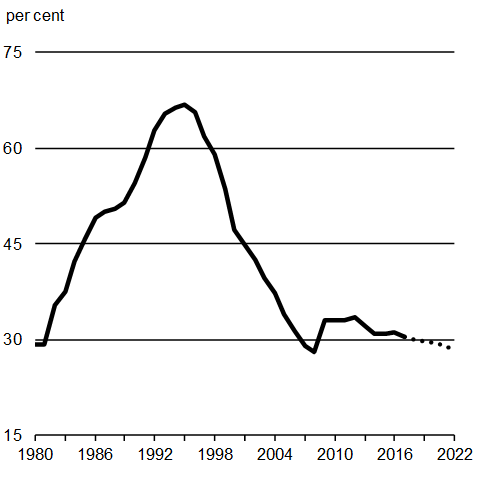

Canadians understand that a country can’t cut its way to prosperity. They have the confidence to invest in the future, and the Government has the ability to do so. Canada’s strong fiscal fundamentals—anchored by a low and consistently declining debt-to-GDP (gross domestic product) ratio—means that Canada can make the investments that will strengthen and grow the middle class, and lay a more solid foundation for our children’s future.

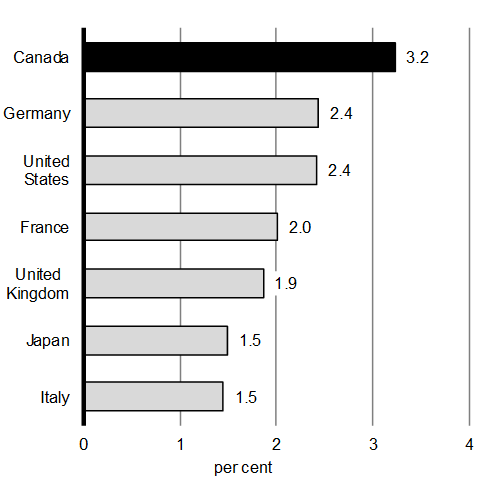

The result? Instead of continued low growth from unneeded austerity, Canada now has the fastest growing economy in the Group of Seven (G7), and the International Monetary Fund (IMF) has argued that Canada’s economic policies should “go viral.” The Government’s investments in people and in the communities they call home are delivering greater opportunities for the middle class, and for all Canadians. Targeted investments, combined with the hard work of Canadians, have helped create good, well-paying jobs—and will continue to strengthen the economy over the long term.

Measures like the middle class tax cut and the new Canada Child Benefit mean that Canadian families now have more money to save, invest and spend in their communities. Historic investments in public transit, green infrastructure and social infrastructure—such as early learning and child care and affordable housing—combined with investments in an ambitious Innovation and Skills Plan, will ensure that all Canadians have the support they need to compete and succeed.

Budget 2018 builds on this plan of investment over austerity, while maintaining a clear focus on fiscal responsibility and continuously improving fiscal results.

Canadian Economic Context

The Government’s plan to invest in people, in communities and in the economy has put more money in the pockets of Canadians, has helped create more well-paying jobs and is giving Canadians greater confidence in their future.

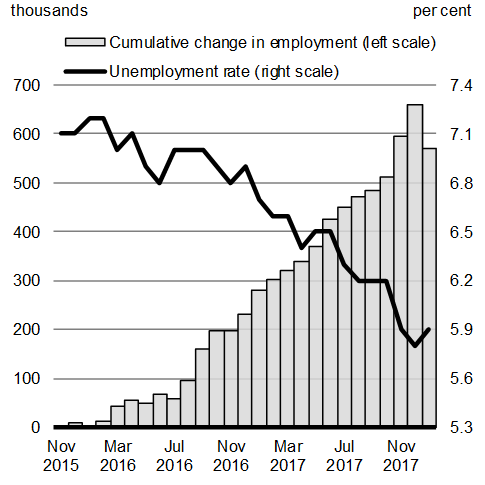

Since November 2015, Canadians have created almost 600,000 new jobs and the unemployment rate has fallen from 7.1 per cent to 5.9 per cent—close to its lowest level in over four decades. The Canadian economy has been remarkably strong, growing at a pace well above that of all other G7 countries since mid-2016 (Chart 1).

Source: Statistics Canada.

Source: Haver Analytics.

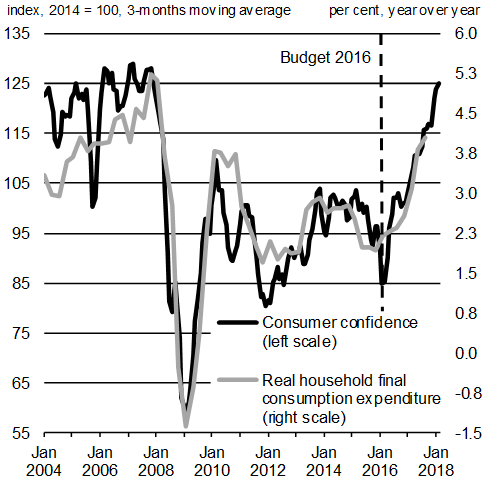

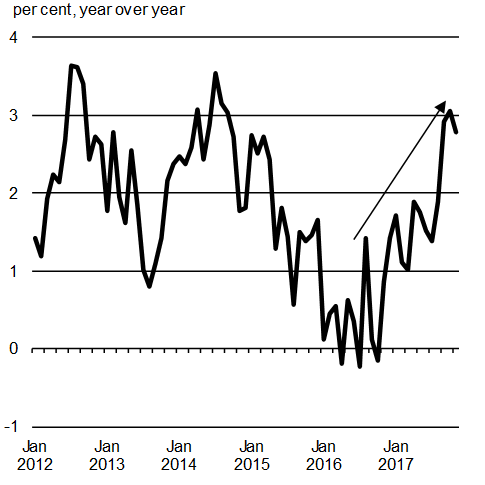

Strong output growth and a robust labour market—along with the measures that the Government has put in place to support the middle class over the past two years—are driving higher levels of Canadian consumer and business confidence and supporting wage growth (Chart 2). This positive sentiment and higher earnings are translating into solid growth in household spending and a recovery in business investment, which should continue to support economic growth.

Growth and Consumer Confidence

Sources: Statistics Canada; The Conference Board of Canada.

Source: Statistics Canada, Survey of Employment, Payroll and Hours (SEPH).

Going forward, growth is expected to remain robust—however, upside and downside risks remain which could affect the economic outlook. In particular, global growth could surprise on the upside, and elevated confidence in Canada could continue to boost household spending here at home. However, uncertainty about the future of the North American Free Trade Agreement, tighter financial conditions and ongoing market volatility could weigh on Canadian growth prospects.

“If you are looking for a country that has the diversity, the resilience, the positivity and the confidence that will not just manage this change but take advantage of it, there has never been a better time to look to Canada.”

-

Highly skilled, inclusive, diverse, mobile labour force

- Most educated talent pool in the Organisation for Economic Co operation and Development (OECD)—over 55 per cent of the population aged 25-64 has a post-secondary degree

- Best availability of skilled labour in the G20 (International Institute for Management Development (IMD) World Competitiveness Center)

- Highest workforce-ready immigration inflows in the G7

- Budget 2018: plan to increase labour force participation of women, new Canadians and Indigenous Peoples

- World-class science, research and innovation ecosystem

- Leading the G20 in research and development (R&D) spending in higher education as a share of GDP (OECD)

- One of the best R&D tax incentives in the G7

- Budget 2018: largest investment in fundamental research ($3 billion) in Canadian history

- Rich and diverse natural environment and resources

- Exceptional endowment of energy and mineral resources

- Responsible and predictable climate change policies

- New, more predictable environmental assessment process

- Budget 2018: $1.3 billion in investment to protect Canada’s nature legacy

- Sound regulatory, financial and trade frameworks

- Easiest place to start a business in the G20 (World Bank)

- Network of free trade agreements covering over half of global economic activity

- Promotion of investment and attraction of leading global firms through the new Invest in Canada Hub

- One of the world’s soundest banking systems—ranked first in the G7 (World Economic Forum)

- Strong, stable and predictable public institutions

- Growth-enhancing, responsible fiscal policy

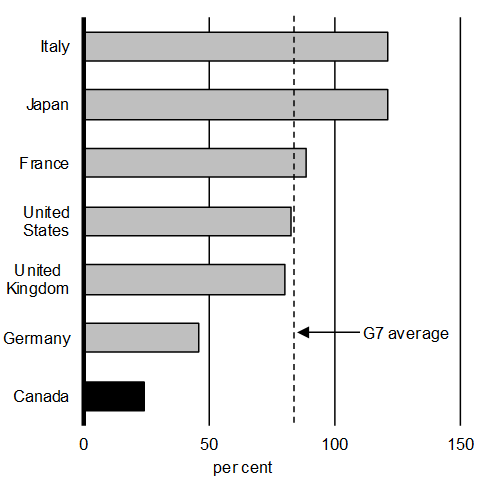

- Lowest net public debt as a share of GDP in the G7

- Successful inflation-targeting regime

Budget 2018 Investments

The Government continues to strengthen the middle class and make investments to support Canada’s long-term economic growth. Challenges posed by population aging, global climate change and rapid technological innovation underscore the importance of strong leadership and a forward-looking approach to strengthen growth for the middle class.

Budget 2018 continues the Government’s plan to invest in the middle class and puts a special focus on ensuring that all Canadians have the skills and opportunities they need to participate fully and equally in our economy. Budget 2018 also makes investments to put Canada at the forefront of scientific and technological innovation, protect Canada’s natural heritage and create opportunities for Indigenous people.

| Projection | ||||||

|---|---|---|---|---|---|---|

| 2017– 2018 |

2018– 2019 |

2019– 2020 |

2020– 2021 |

2021– 2022 |

2022– 2023 |

|

| FES 2017 budgetary balance | -19.9 | -18.6 | -17.3 | -16.8 | -13.9 | -12.5 |

| Adjustment for risk from FES 2017 | 1.5 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 |

| FES 2017 budgetary balance (without risk adjustment) |

-18.4 | -15.6 | -14.3 | -13.8 | -10.9 | -9.5 |

| Economic and fiscal developments since FES 2017 | 3.0 | 3.6 | 4.1 | 3.5 | 2.8 | 2.8 |

| Revised budgetary balance before policy actions and investments | -15.4 | -12.0 | -10.3 | -10.3 | -8.1 | -6.7 |

| Policy actions since FES 2017 | 2.4 | 2.2 | -1.7 | -1.6 | -0.5 | 0.3 |

| Investments in Budget 2018 | ||||||

| Growth | 0.0 | 0.3 | -0.1 | 0.3 | 0.2 | 0.3 |

| Progress | 0.0 | -0.9 | -1.2 | -1.4 | -1.4 | -1.6 |

| Reconciliation | -0.1 | -1.4 | -1.2 | -0.8 | -0.7 | -0.6 |

| Advancement | -4.2 | -1.8 | -1.3 | -1.3 | -1.2 | -0.6 |

| Other Budget 2018 investments | -2.1 | -1.6 | 1.1 | 1.1 | 0.9 | -0.4 |

| Total investments in Budget 2018 | -6.3 | -5.4 | -2.6 | -2.0 | -2.2 | -3.0 |

| Total policy actions and investments | -4.0 | -3.1 | -4.3 | -3.6 | -2.7 | -2.6 |

| Budgetary balance | -19.4 | -15.1 | -14.5 | -13.9 | -10.8 | -9.3 |

| Adjustment for risk | -3.0 | -3.0 | -3.0 | -3.0 | -3.0 | |

| Final budgetary balance (with risk adjustment) |

-19.4 | -18.1 | -17.5 | -16.9 | -13.8 | -12.3 |

| Federal debt (per cent of GDP) | 30.4 | 30.1 | 29.8 | 29.4 | 28.9 | 28.4 |

Maintaining a Downward Deficit Track

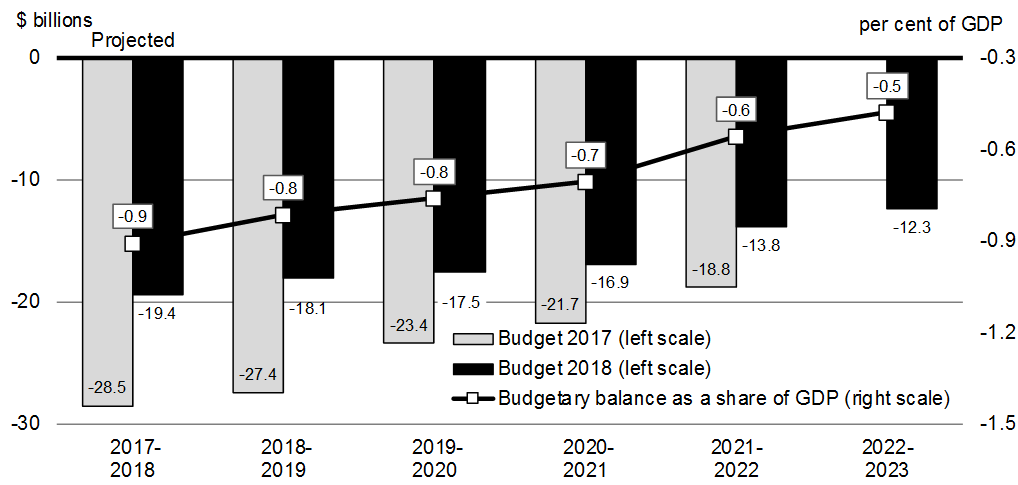

Growth-generating investments in people, in communities and in the economy are balanced by sound fiscal management. The Budget 2018 fiscal track is broadly unchanged from the 2017 Fall Economic Statement and continues to show a decline in the federal debt-to-GDP ratio, along with steady improvements in the Government’s annual budgetary balance (Charts 3 and 4).

The federal debt-to-GDP ratio is projected to decline gradually over the forecast horizon, reaching 28.4 per cent in 2022–23. According to the IMF, Canada’s net debt-to-GDP ratio is by far the lowest among G7 countries and less than half the G7 average (Chart 3).

Source: IMF, October 2017 Fiscal Monitor.

The Government will maintain this downward deficit and debt ratio track—preserving Canada’s low-debt advantage for current and future generations. Low debt supports economic growth and intergenerational equity by keeping interest costs low and preserving flexibility to face future challenges and shocks.

A detailed overview of the economic and fiscal outlook is included in Annex 2.

Continued Economic Strength Would Accelerate Deficit Reduction

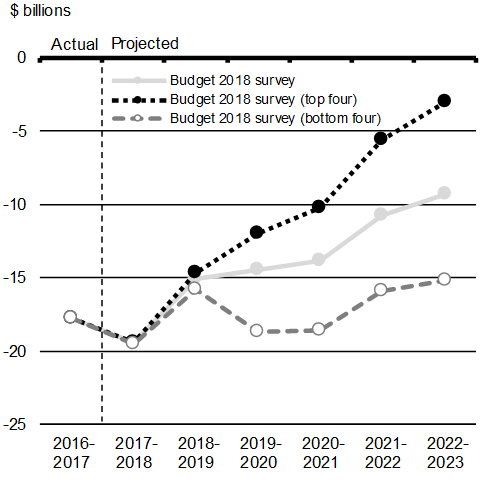

The fiscal projections presented in this budgetare based on an average of the December 2017 private sector economic outlook survey, and also reflect upside and downside risks, noted above, identified through ongoing engagement with survey participants. Economists surveyed offered a wide range of views regarding future economic growth and, therefore, the path of nominal GDP (the broadest measure of the tax base). Changes in economic growth assumptions can have large impacts on the budgetary balance and debt-to-GDP profile over an extended projection horizon.

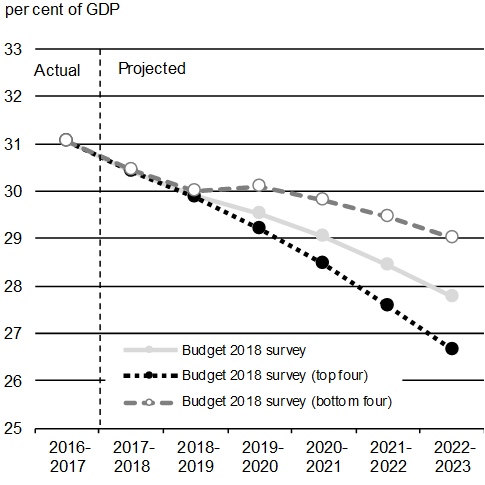

For example, if the Government based current fiscal projections on the average of the top four forecasts for nominal GDP growth, the budgetary balance would improve by $3.0 billion per year on average, and the federal debt-to-GDP ratio would fall by a further 1.1 percentage points than projected by 2022–23 (Chart 5).

Conversely, basing fiscal projections on the average of the bottom four individual forecasts for nominal GDP growth, the budgetary balance would worsen by $3.5 billion per year on average, and the federal debt-to-GDP ratio would still decline, but be 1.2 percentage points higher than projected in 2022–23

- Date modified: