Growth

"More women in leadership positions won’t just grow our economy, create jobs, and strengthen our communities. It will also lead to innovation and change in the workplace—innovation and change that workers so desperately need."

Making sure every Canadian has an equal and fair chance at success isn’t just the right thing to do, it’s the smart thing to do. Canada’s future prosperity depends on it.

To face the challenges of today and tomorrow, we will need the hard work and creativity of all Canadians. And in return, we need to make sure that the benefits of a growing economy are felt by more and more people—with more good, well-paying jobs for the middle class and everyone working hard to join it.

Over the last two years, Canada’s economic growth has been fuelled by a stronger middle class. Canadians’ hard work, combined with historic investments in people and in communities, helped to create more good jobs—while more help for those who need it most has meant more money for people to save, invest, and spend in their communities.

But there is more to do.

In Budget 2018, the Government is introducing new measures to help build an economy that truly works for everyone.

Introducing the Canada Workers Benefit, a strengthened version of the Working Income Tax Benefit, means that low-income workers can take home more money while they work—encouraging more people to join the workforce, and offering real help to more than 2 million Canadians, who are working hard to join the middle class.

Strengthening the Canada Child Benefit will give hard-working moms and dads more money each month to buy the things their families need—with the most help going to the families who need it most.

Improving parental benefits will help parents to share the burden of care at home more equally, while allowing people the flexibility to return to work sooner, if they so choose.

And introducing historic pay equity legislation will give more Canadian women fair compensation for their hard work and will set the standard for how women’s work is valued in the workplace. The Government is proud to lead these efforts to reduce the gender wage gap and ensure that women working in federally regulated industries receive equal pay for work of equal value.

The Government will also continue its investments in skills and training programs to give Canadians from all backgrounds the skills they need to succeed in an increasingly globalized world.

Budget 2018 also includes new measures to connect Canadian businesses with global customers, by strengthening and diversifying Canada’s trade relationships around the world.

Underpinning the Government’s efforts to help strengthen and grow the middle class is an unwavering commitment to equality of opportunity, and a belief that the wealthiest Canadians must pay their fair share. In addition to finalizing its plans to address tax planning strategies used by a few wealthy owners of private corporations, the Government is taking further action to close loopholes and combat aggressive international tax avoidance.

Key Chapter 1 initiatives that advance objectives of Canada’s new Gender Results Framework:

- Improving access to the Canada Child Benefit and other benefits in Indigenous communities

- Addressing the gender wage gap by supporting equal pay for equal work in federally regulated workplaces and implementing pay transparency

- Promoting more equal parenting roles with a new Employment Insurance Parental Sharing Benefit

- Helping women enter and succeed in the trades

More Help for the Middle Class and People Working Hard to Join It

The Government has a plan to invest in the middle class and people working hard to join it. This includes more support for those who need it most, to ensure that the benefits of growth are widely shared.

Over the last four decades, lower- and middle-income workers have seen their wage prospects stall—making it more difficult to make ends meet each month. At the same time, the number of Canadians in low-wage jobs is high by international standards, and many of these workers struggle to support their families and afford basics like healthy food and clothes for growing kids.

Introducing the Canada Workers Benefit

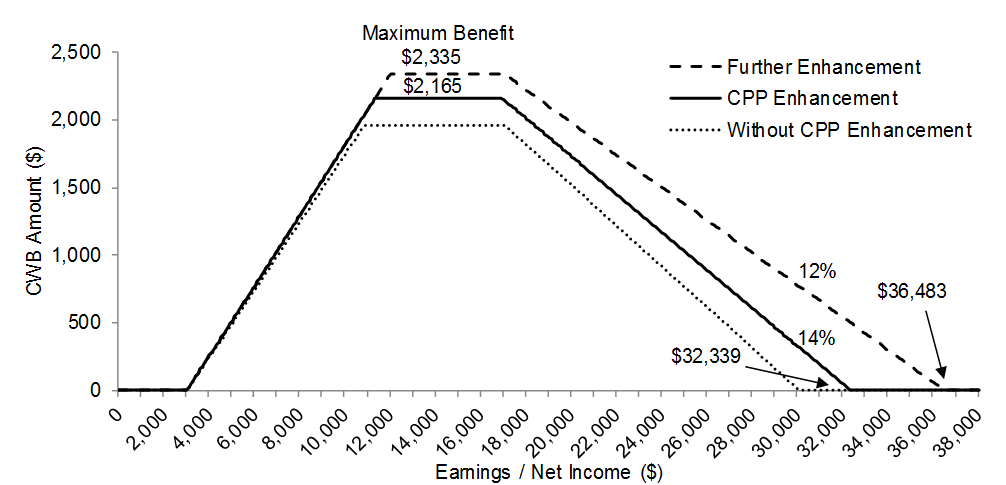

The Working Income Tax Benefit (WITB) is a refundable tax credit that supplements the earnings of low-income workers. By letting low-income workers take home more money while they work, the benefit encourages more people to join and remain in the workforce, and currently offers real help to Canadians who are working hard to join the middle class.

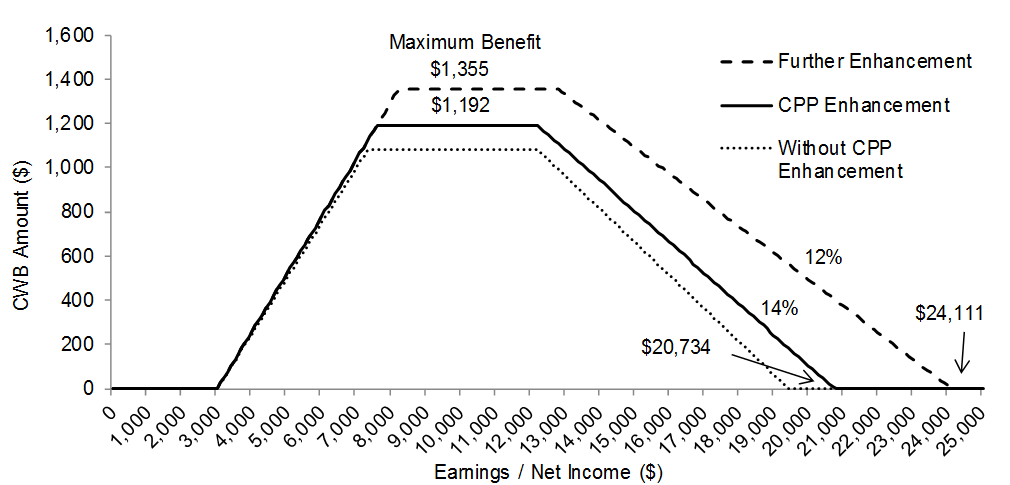

First introduced in the fall of 2005, the WITB has evolved over time. In 2016, the Government announced a $250 million enhancement of the WITB, starting in 2019, as part of the enhancement of the Canada Pension Plan. In the 2017 Fall Economic Statement, the Government committed to further enhance the WITB by an extra $500 million annually. This will put more money in the pockets of low-income workers, and give people a little extra help as they transition to work.

In Budget 2018, the Government proposes to strengthen the program by making it more generous, and making the benefit more accessible. This strengthened benefit will be named the Canada Workers Benefit (CWB) and will take effect in 2019.

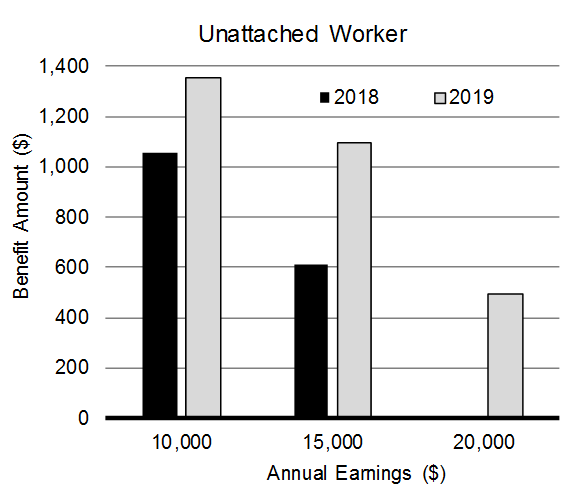

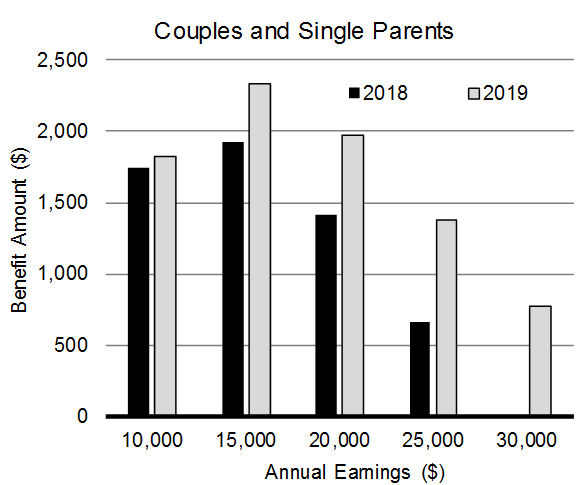

Using the funding announced in the 2017 Fall Economic Statement, the Government proposes to increase maximum benefits under the CWB by up to $170 in 2019 and increase the income level at which the benefit is phased out completely. The Government also proposes to increase the maximum benefit provided through the CWB disability supplement by an additional $160 to offer greater support to Canadians with disabilities who face financial barriers to entering the workforce.

As a result of these enhancements, a low-income worker earning $15,000 a year could receive up to nearly $500 more from the program in 2019 than she received in 2018. That’s more money to spend on things like groceries, utility bills and other essentials.

Enhancing the Canada Workers Benefit, 2019

CWB Enhancement for Unattached Workers, 2019

CWB Enhancement for Couples and Single Parents, 2019

Department of Finance Canada analysis has shown that eligible workers who file their own taxes using paper forms are more likely than those who file electronically to miss out on claiming this benefit. Allowing the CRA to automatically provide the benefit to eligible filers would be especially helpful to people with reduced mobility, people who live far from service locations and people who don’t have Internet access. Additional investments in outreach activities and the CRA’s Community Volunteer Income Tax Program will also support access to benefits for vulnerable groups.

Improving Access to the Canada Workers Benefit

At the same time, the Government recognizes that not all low-income workers are receiving the CWB (previously WITB) payment that they are entitled to. This happens because some lower-income workers do not claim the benefit on their tax return. The Government is proposing amendments that will allow the Canada Revenue Agency (CRA) to automatically determine whether these tax filers are eligible for the benefit. An estimated 300,000 additional low-income workers will receive the new CWB for the 2019 tax year as a result of these changes. This represents a major step forward in fulfilling the Government’s commitment of making sure that all Canadians receive the tax benefits and credits to which they are entitled.

CWB enhancements, combined with new investments to make sure that every worker who qualifies actually receives the benefit, will mean that the Government is investing almost $1 billion of new funding for the benefit in 2019, relative to 2018. The Government estimates that enhancements and improved take-up in 2019 will directly benefit more than 2 million working Canadians, many of whom were not benefitting from the WITB. This will help lift approximately 70,000 Canadians out of poverty.

Moving forward, the Government will continue to work with interested provinces and territories to harmonize benefits and help support the transition from social assistance and into work. Quebec, Alberta, British Columbia and Nunavut have already taken advantage of the opportunity to make province- and territory-specific changes to the design of the program.

In addition, over the next year, the Government will also begin work on improving the delivery of the CWB to provide better support to low-income Canadians throughout the year, rather than through an annual refund after filing their taxes.

Andie is a single, 20-year-old woman who works part-time at a second-hand store. After recovering from a serious illness, Andie was eager to begin working again but has struggled to find a full-time job. Although she qualified to receive the Working Income Tax Benefit, she wasn’t aware of the program until a co-worker mentioned it to her after tax filing time. With the improvements the Government is proposing under the new Canada Workers Benefit, workers like Andie will automatically receive the CWB, starting in the 2019 tax year.

Strengthening the Canada Child Benefit

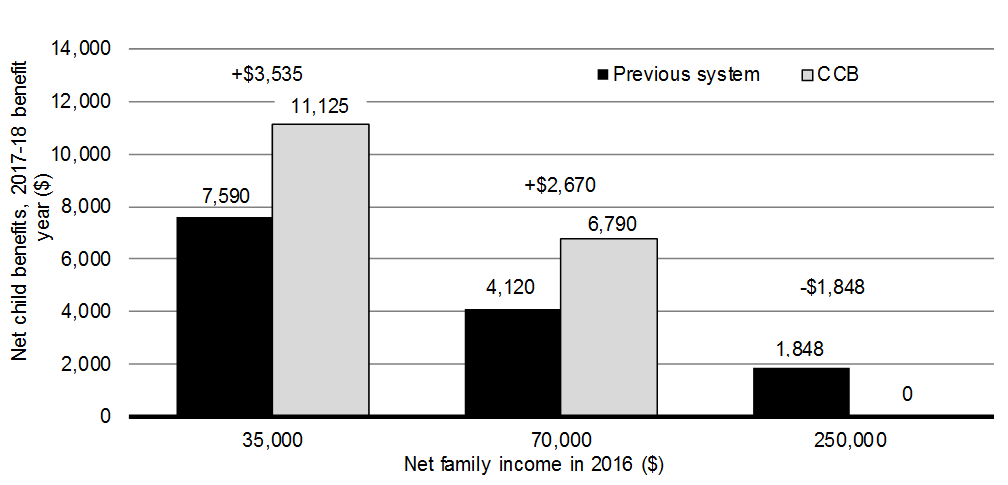

The Canada Child Benefit (CCB), introduced in 2016, gives low- and middle-income parents more money each month, tax-free, to help with the high costs of raising kids. Compared to the old system of child benefits, the CCB is simpler, more generous and better targeted to give more help to people who need it most.

Thanks to the CCB, nine out of 10 Canadian families have extra help each month to pay for things like sports programs, music lessons and back-to-school clothes. The benefit helps almost 6 million children—putting more than $23 billion back in the bank accounts of hard-working Canadian families. Families receiving the CCB are getting $6,800 on average this year. Since its introduction in 2016, the CCB has helped lift hundreds of thousands of Canadian children out of poverty.

Comparison of Canada Child Benefit and Old Child Benefit System, 2017–18

To ensure that the CCB continues to help Canadian families over the long term, the 2017 Fall Economic Statement indexed CCB benefits, starting in July 2018, to keep pace with the cost of living. Indexing the CCB will provide an additional $5.6 billion in support to Canadian families over the 2018–19 to 2022–23 period.

Myriam is a single mother of two children aged 5 and 8. Her net income was $35,000 in 2016. Myriam’s family will have received $11,125 in tax-free CCB payments in the 2017–18 benefit year, $3,535 more than she would have received under the old system of child benefits.

Last year, single mothers earning less than $60,000 a year received about $9,000 in benefit payments on average to help make things like healthy food, summer programs and winter clothes more affordable

Improving Access to the Canada Child Benefit and Other Benefits

Indigenous Peoples, in particular those living in remote and northern communities, face distinct barriers when it comes to accessing federal benefits such as the Canada Child Benefit. To help Indigenous Peoples access the full range of federal social benefits, the Government will provide $17.3 million over three years, starting in 2018–19, to expand outreach efforts to Indigenous communities, and to conduct pilot outreach activities for urban Indigenous communities.

Enhancing the Wage Earner Protection Program

Innovation is changing how we live and work, bringing with it new realities for Canadian workers. To support workers in this new environment, the Government will propose legislative amendments to the Wage Earner Protection Program Act to increase the maximum payment under the Wage Earner Protection Program to seven weeks of Employment Insurance insurable earnings from four. Changes will also be made to make eligibility for the Program more equitable, so that workers who are owed wages, vacation, severance or termination pay when their employer files for bankruptcy or enters receivership receive greater support during a difficult time.

A More Secure Retirement

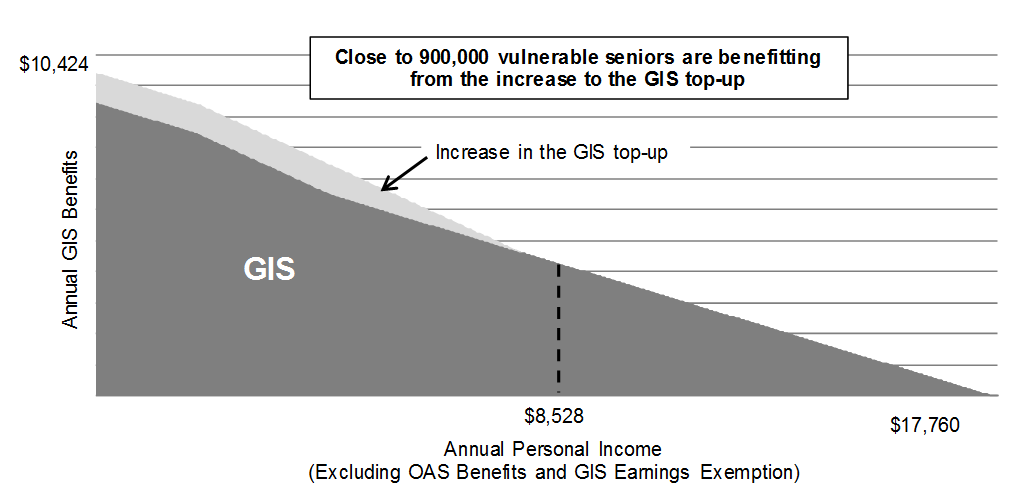

Every Canadian deserves a secure retirement, free of financial worries. Canada’s public pensions—the Old Age Security (OAS) program and the Canada and Quebec Pension Plans—play an important role in giving Canadians confidence that they can retire in dignity. The Government is committed to strengthening public pensions and to improving the quality of life for seniors now, and for generations to come.

Since 2016, the Government has:

- Increased Guaranteed Income Supplement (GIS) payments by up to $947 per year for single recipients, which is helping nearly 900,000 low-income seniors, of which 70 per cent are women.

- Ensured that senior couples who receive GIS and Allowance benefits and have to live apart—because of long-term care requirements, for example—can receive higher benefits based on their individual incomes.

- Restored the eligibility age for OAS and GIS benefits to 65, putting thousands of dollars back in the pockets of Canadians as they become seniors.

Annual GIS Benefits for Single Seniors, 2017

In June 2016, the Government reached an historic agreement with provinces to enhance the Canada Pension Plan (CPP). The CPP Enhancement, which will begin to be phased in as of January 2019, means more money for Canadians when they retire, so that they can worry less about their savings and focus more on enjoying time with their families. With the action taken by Quebec to enhance the Quebec Pension Plan in a similar fashion, all Canadian workers can now look forward to a safer and more secure retirement.

The CPP Enhancement will give Canadian workers greater income security when they retire, and offers a number of advantages over other types of savings:

- It will provide a secure, predictable benefit in retirement, so Canadians can worry less about outliving their savings, and be less anxious about the safety of their investments.

- Benefits will be indexed, which means that they will keep up with the cost of living.

- It is a good fit for both experienced workers and young people entering Canada’s changing job market for the first time. The Enhancement will help to fill the gap left by declining workplace pension coverage, and will be portable across jobs and provinces.

The CPP Enhancement will be phased in gradually starting in 2019 and will raise the maximum CPP retirement benefit by up to 50 per cent over time. This translates into an increase in the current maximum retirement benefit of more than $7,000, from $13,610 to nearly $21,000 in today’s dollar terms.

Building on this achievement, in December 2017, federal and provincial Ministers reached a unanimous agreement in principle to take the following actions, beginning in 2019:

- Increase retirement benefits under the CPP Enhancement both for parents who take time off work to care for young children, and for persons with severe and prolonged disabilities. For the purposes of calculating the retirement pension, parents and persons with disabilities will be credited with an amount linked to their previous earnings for periods spent out of the workforce, or periods with low earnings.

- Raise survivor’s pensions for individuals under age 45 who lose their spouse, by providing a full survivor’s pension instead of the current reduced pension that is linked to the age of the widow or widower.

- Provide a top-up disability benefit to retirement pension recipients under the age of 65 who are disabled and meet eligibility requirements.

- Increase the death benefit to its maximum value of $2,500 for all eligible contributors.

The Government intends to introduce legislation to implement the agreement reached by Ministers, along with technical and consequential amendments. The proposed changes would not result in an increase to contribution rates.

Protecting Canadians’ Pensions

In recent years, we have seen companies, such as Sears Canada, entering the insolvency process with substantial unfunded pension liabilities. As a result, workers and pensioners, who have paid into pension plans over their careers, are faced with unexpected financial losses that impact their retirement security.

All Canadians deserve more peace of mind when it comes to their retirement and companies must act in good faith towards their employees. At the same time, we recognize the challenges facing courts as they try to maximize recovery in bankruptcies that affect not just workers and pensioners, but also small businesses, lenders, and other creditors which are owed money. Our government is committed to finding a balanced way forward.

That’s why, over the coming months, we will be looking to obtain feedback from pensioners, workers, and companies. We will take a whole-of-government, evidence-based approach towards addressing retirement security for all Canadians.

Building More Rental Housing for Canadian Families

Finding a safe and affordable place to call home is a challenge for a growing number of Canadians. Many of our cities lack affordable rental housing, and growing populations and the rising cost of home ownership make it more challenging to find—and afford—a good place to live. The high demand for housing in many communities drives up rental rates and makes it more difficult for Canadians to live and work in the same community.

Approximately 30 per cent of Canadians rely on the rental market for housing. While patterns will vary across cities, future demand for affordable rental housing is expected to rise as the population ages, young professionals migrate to larger cities, and immigration continues to grow our communities. Canadians who wish to buy a home now need a longer period of time to save for a down payment, especially in Canada’s biggest cities.

In April 2017, Canada Mortgage and Housing Corporation launched the Rental Construction Financing Initiative, which will provide $2.5 billion in low-cost loans to support the construction of new rental housing, relieving pressure in rental markets that are experiencing low vacancy rates.

To be eligible, borrowers must demonstrate that their projects are financially viable without ongoing operating subsidies. The Financing Initiative will prioritize projects that demonstrate greater social outcomes and may offer a loan for up to 100 per cent of the cost of these projects. Borrowers must meet minimum requirements for affordability, energy efficiency and accessibility. Lower-cost loans will be provided for terms of up to 10 years, making costs more predictable during the earliest and most challenging phases of development.

Unfortunately, high demand for rental housing has not translated into an increase in supply. Vacancy rates remain low in large urban centres such as Toronto and Vancouver—at 1.0 per cent and 0.9 per cent, respectively.

To encourage a stable supply of affordable rental housing across the country, the Government proposes to increase the amount of loans provided by the Rental Construction Financing Initiative from $2.5 billion to $3.75 billion over the next three years. This new funding is intended to support projects that address the needs of modest- and middle-income households struggling in expensive housing markets. In total, this measure alone is expected to spur the construction of more than 14,000 new rental units across Canada. The Government proposes to provide $113.6 million over five years, starting in 2018–19, to Canada Mortgage and Housing Corporation to expand the Rental Construction Financing Initiative.

Equality in the Workforce

Women represent half of Canada’s population, and their full and equal participation in Canada’s economy is essential for our future. Removing the systemic barriers to women’s full economic participation will support economic growth, strengthen the middle class, and build a fairer society that gives everyone a real and fair chance at success.

Addressing the Gender Wage Gap

In Canada today, women earn 31 per cent less than men do. Put another way, the median income for women is $28,120, compared with $40,890 for men. The reasons behind the gender wage gap are deep-rooted and complex. Closing the gap will require leadership and a comprehensive approach, involving multiple tools.

The gender wage gap is the average difference between what a woman makes relative to a man in the workplace, and it is a good indicator of the broader state of gender equality in society.

Right now in Canada, the median annual earning for a woman is about 31 per cent lower than the median earning for a man. This is due to a number of factors, including a greater proportion of women in part-time jobs and in lower-paid fields, sectors and occupations. There are also a range of work, family and societal issues that contribute to this gap, from discrimination in the workplace to stereotypes about gender roles, to unequal sharing of caregiving responsibilities, leading to fewer hours worked by women.

The net result is that women in Canada have a lower earning potential, and fewer opportunities to advance their career, or move into a position of leadership.

One of the main causes of the gender wage gap is the undervaluation of the work that has traditionally been done by women. Requiring equal pay for work of equal value is an effective way to fix this gap. To help address this issue, the Government will bring in a legislated proactive pay equity regime in federally regulated sectors, which would apply to approximately 1.2 million employed individuals.

The difficulty of balancing work and family life, combined with the fact that caregiving responsibilities—from child rearing to caring for aging family members—more often than not fall to women, is another cause of the gender wage gap. This can lead women to work shorter hours, or look for jobs that offer more flexibility, which can mean fewer hours worked and fewer opportunities for advancement over a lifetime. Greater flexibility for parents receiving parental benefits, including in the sharing of leave, can help balance caring responsibilities within the home, and provide women with the option to return to work sooner, should they wish to do so. Access to affordable child care is another key factor in encouraging women back into the workforce. Measures to advance women in leadership and promote participation in non-traditional careers can also contribute to closing the gender wage gap.

Progress Toward Equal Pay for Equal Work

When Canadian women have more opportunities to work and earn a good living, everyone benefits. McKinsey Global Institute estimates that by taking steps to advance greater equality for women—such as reducing the gender wage gap by employing more women in technology, and boosting women’s participation in the workforce—Canada could add $150 billion to its economy by 2026.

There is significant progress required. For every dollar of hourly wages a man working full-time earns in Canada, a woman working full-time earns about 88 cents. Canada ranks 15th out of 29 OECD countries based on the hourly gender wage gap. This disparity persists despite the fact that pay equity is a human right entrenched in law. As the largest employer in the country, many have called on the federal government to lead by example—and that is what the Government will do.

To ensure that employees in federally regulated workplaces receive equal pay for work of equal value, Budget 2018 will move forward with new proactive pay equity legislation. This will be included in budget implementation legislation.

This legislation will draw on models in Ontario and Quebec but will take an innovative approach to ensure that on average, women and men in federally regulated sectors receive the same pay for work of equal value. Preliminary estimates suggest this could reduce the gender wage gap by about 2.7 cents for the core public administration (to 94.1 cents on the dollar), and by about 2.6 cents in the federal private sector (to 90.7 cents on the dollar). This analysis will be refined further as the legislation moves forward.

To address the complexity of the federal sectors, this legislation would:

- Apply to federal employers with 10 or more employees, with pay equity requirements built as much as possible into existing federal compliance regimes.

- Establish a streamlined pay equity process for employers with fewer than 100 employees.

- Set out specific timelines for implementation, and compulsory maintenance reviews.

- Include job types such as seasonal, temporary, part-time and full-time positions.

- Provide independent oversight.

- Ensure that both wages and other benefits are evaluated in a gender-neutral way.

- Apply to the Federal Contractors Program on contracts equal to or greater than $1 million, and ensure a robust application of federal employment equity law.

- Repeal previous legislation such as the Public Sector Equitable Compensation Act which is inconsistent with the goal of pay equity.

The Government will continue to consult with employers, unions and other stakeholders in the coming months to ensure that the new regime will be applied fairly and will achieve its intended purpose. While proactive pay equity legislation is an important tool to close the gender wage gap, it needs to be part of a broader array of policy tools such as the Government’s investments in early learning and child care, enhanced training and learning financing, enhanced parental leave flexibility, pay transparency and the continued appointment of talented women into leadership positions.

Pay Transparency

The Government will provide Canadians with more information on pay practices of employers in the federally regulated sector. This would include converting existing pay information filed by federally regulated employers under the Employment Equity Actinto more user-friendly online content, with specific attention paid to making existing wage gaps more evident. This will help to highlight employers who lead in equitable pay practices, while holding employers accountable for wage gaps that affect women, Indigenous Peoples, persons with disabilities and visible minorities. Experience in other jurisdictions has shown it to be helpful in raising awareness about the wage gap. The Government will commit $3 million over five years, starting in 2018–19, to implement pay transparency.

Recognizing that barriers to women’s labour market participation can be complex and slow to move, the Government will also host a major symposium on women and the workplace in the spring of 2019. This symposium will bring together leaders in the private and public sectors to discuss and share best practices. The objective of the symposium would be to encourage and provide tools for Canadian employers to address issues faced by women in the workplace, from wage gaps to harassment. The Government will provide $1.5 million over 2018–19 and 2019–20 for this symposium.

Closing the wage gap between men and women requires action on many fronts. Investing in affordable and accessible child care and family leave, increasing women’s participation in traditionally male-dominated occupations, encouraging men to work in traditionally female-dominated occupations, implementing family-friendly workplace policies and challenging gender stereotypes that reinforce notions of “appropriate” work for men and women are some of these areas. Through Budget 2018, the Government will take targeted action to advance these goals—recognizing the significant work that remains to be done.

Supporting Equal Parenting and the Flexibility for Earlier Returns to Work

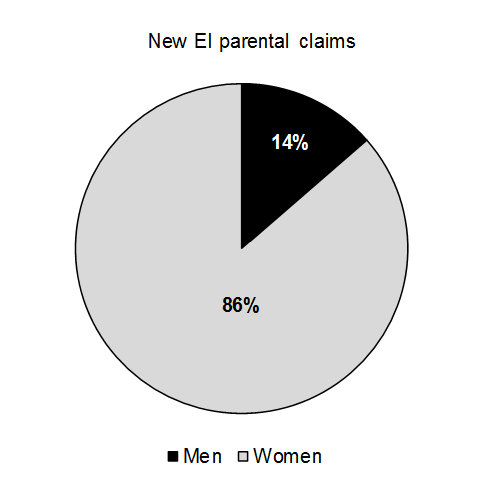

For most Canadians, starting a family typically comes at the same time that parents-to-be are working to establish or further their careers. To help new parents care for their children during those critical early months, Employment Insurance (EI) maternity and parental benefits are available. These help to provide greater financial security when parents are away from work.

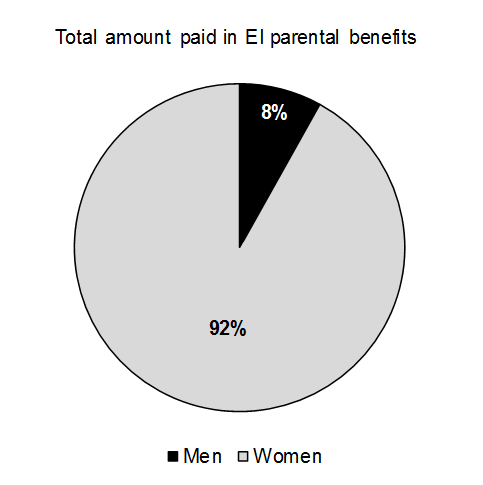

EI parental benefits are available to both parents, allowing either parent to take time off work. The most common scenario, however, involves the mother taking on the primary caregiving responsibilities once their child is born. While the second parent may take on many household and caregiving responsibilities, child care duties continue to fall disproportionately to mothers, both in the short term following the arrival of their child, and over the longer term, often due to the challenges of re-entering the workforce after time spent away.

Women Account for the Vast Majority of New EI Parental Claims and of the Total Amount Paid in EI Parental Benefits

Budget 2017 announced greater flexibility for families by allowing parents to choose to receive up to 61 weeks of EI parental benefits over an extended period of 18 months at a lower benefit rate of 33 per cent of average weekly earnings. Previously, 35 weeks of EI parental benefits were available at the standard benefit rate of 55 per cent to be paid over a period of 12 months. Making EI parental benefits more flexible helps working parents navigate the challenges that come with a growing family.

To support greater gender equality in the home and in the workplace, the Government proposes to provide $1.2 billion over five years, starting in 2018–19, and $344.7 million per year thereafter, to introduce a new EI Parental Sharing Benefit.The Benefit will provide additional weeks of “use it or lose it” EI parental benefits, when both parents agree to share parental leave.This incentive is expected to be available starting June 2019.

This builds on best practices in Quebec and other jurisdictions which have found that incentives play a key role in who takes time off to provide caregiving. In 2016, for example, 80 per cent of new fathers in Quebec claimed or intended to claim parental benefits, in part because of leave that was specifically reserved for them. In the rest of Canada, which does not provide second parent leave, this same figure is only 12 per cent.

The proposal is also informed by recent recommendations from the Canada-U.S. Council for Advancement of Women Entrepreneurs and Business Leaders, which has identified the need for better parental leave policies as key to the economic empowerment of women.

The proposed benefit will be available to eligible two-parent families, including adoptive and same-sex couples, to take at any point following the arrival of their child. This Benefit would increase the duration of EI parental leave by up to five weeks in cases where the second parent agrees to take a minimum of five weeks of the maximum combined 40 weeks available using the standard parental option of 55 per cent of earnings for 12 months. Alternatively, where families have opted for extended parental leave at 33 per cent of earnings for 18 months, the second parent would be able to take up to eight weeks of additional parental leave. In cases where the second parent opts not to take the additional weeks of benefits, standard leave durations of 35 weeks and 61 weeks will apply.

Providing additional weeks of benefits will help encourage greater equality when it comes to child care, and improve the distribution of family and home responsibilities. It will also provide greater flexibility—particularly for mothers—to return to work sooner, if they so choose, knowing their family has the support it needs. More equitable parental leave will also help lead to more equitable hiring practices, reducing conscious and unconscious discrimination by employers.

To implement this change to the EI program, the Government proposes to amend the Employment Insurance Act. In addition, the Government proposes to amend the Canada Labour Code to ensure that workers in federally regulated industries have the job protection they need while they are receiving EI parental benefits.

Emman and Simon are expecting a child. In addition to the 15 weeks of EI maternity benefits that Emman is eligible for, the couple is eligible to receive and share up to 35 weeks of EI parental benefits (paid at 55 per cent of their average weekly earnings).

Together, Emman and Simon have decided that both of them will take leave from work and share EI parental benefits to care for their child. As a result of the new EI Parental Sharing Benefit, Emman and Simon are eligible for an additional five weeks of benefits when Simon agrees to take a minimum of five weeks.

They decide that Emman will take 20 weeks of parental benefits, while Simon will take the balance of 20 weeks of benefits. In total, Emman is off work for 35 weeks, while Simon is off for 20 weeks, allowing Emman the flexibility to return to work sooner. Simon’s experience on parental leave allows him to bond with his child, become familiar with her routines, and feel more confident in his ability to meet her needs, setting up patterns of equal parenting that will last a lifetime.Examples of How the New EI Parental Sharing Benefit Will Work for a Variety of Family Situations

and access the additional weeks

Natasha and Julie are a same-sex couple. Natasha is pregnant and expecting a child. They decide to apply for the standard parental benefits option.

Current model:

When applying for standard parental benefits, they decide that Natasha will access 30 weeks of benefits, and Julie will access 5 weeks of parental benefits (total of 35 weeks).

Proposed model:

When applying for standard parental benefits, they decide Natasha will access 30 weeks of benefits, and Julie will access 10 weeks of parental benefits (total of 40 weeks because they are sharing). Neither of them exceed the limit of 35 weeks per parent.

If Natasha and Julie had chosen the extended parental benefits option, up to 8 additional weeks of benefits paid at 33 per cent are available when sharing extended parental benefits.

and access the additional weeks

Michel and François plan to adopt a child. They decide that both of them will take leave from work and share the parental benefits to care for their child.

The couple chooses the standard parental benefits option.

Current model:

When applying for standard parental benefits, they decide that Michel will access 25 weeks of benefits, and François will access 10 weeks of parental benefits (total of 35 weeks).

Proposed model:

When applying for standard parental benefits, they decide to distribute the additional weeks between them so that Michel will access 28 weeks of benefits, and François will access 12 weeks of parental benefits (total of 40 weeks because they are sharing). Neither of them exceed the limit of 35 weeks per parent.

If Michel and François had chosen the extended parental benefits option, up to 8 additional weeks of benefits paid at 33 per cent are available when sharing extended parental benefits

and access the additional weeks

Raoul and Maria plan to adopt a child. They decide to apply

for the standard parental benefits option.

Current model:

When applying for standard parental benefits, they decide that Maria will access 20 weeks of benefits, and Raoul will access 15 weeks of parental benefits (total of 35 weeks).

Proposed model:

When applying for standard parental benefits, they decide that Maria will access 35 weeks of benefits, and Raoul will access 5 weeks of parental benefits (total of 40 weeks because they are sharing). Neither of them exceed the limit of 35 weeks per parent.

If Raoul and Maria had chosen the extended parental benefits option, up to 8 additional weeks of benefits paid at 33 per cent are available when sharing extended parental benefits.

Jessica and Mark are expecting a child. They decide to apply

for the standard parental benefits option.

Current model:

The couple decides that Jessica will receive the maximum 35 weeks of standard parental benefits to care for their baby before returning to work.

Mark will not access any weeks of EI parental benefits.

Proposed model:

The couple decides that Jessica will receive the maximum 35 weeks of standard parental benefits to care for their baby before returning to work.

Since they decided that Mark will not access any weeks of EI parental benefits, the couple can only receive a maximum of 35 weeks (total of 35 weeks because they are not sharing). The additional 5 weeks are left on the table.

If Jessica and Mark had chosen the extended parental benefits option, Jessica could receive up to 61 weeks of extended parental benefits. The additional 8 weeks are left on the table

More Accessible and Affordable Early Learning and Child Care

Access to quality child care is a major challenge faced by many Canadian families, with only 1 in 4 Canadian children having access to a regulated child care space. Families are also concerned about child care affordability, with daily child care fees that are high and rising.

The affordability and accessibility of early learning and child care options are important in encouraging women to go back to work after parental leave. When child care fees are too high, many families opt to have one parent stay at home instead of returning to work. This is especially the case for low-income workers, and most often it is women who forgo paid employment. Affordable child care is particularly important for single mothers, who often struggle to secure child care and engage in paid work, and who face a greater risk of poverty than two-parent families.

In Budget 2017, the Government announced a long-term investment of $7.5 billion over 11 years, starting in 2017–18, to support more accessible and affordable early learning and child care.

This was followed, in June 2017, by federal, provincial and territorial governments reaching a historic agreement on a Multilateral Early Learning and Child Care Framework, which will guide new investments in early learning and child care towards five key principles—quality, accessibility, affordability, flexibility and inclusivity.

The Government of Canada is entering into three-year bilateral agreements with provinces and territories, with the intent to review and adjust these agreements as needed at each period of renewal over the 11-year framework. Nine agreements have been reached so far.

Nine bilateral agreements have now been signed with provinces and territories. Here are some of the results Canadians can expect to see in their communities by 2020.

Newfoundland and Labrador

- Up to 540 children will have access to free or low-cost child care due to changes to the Child Care Services Subsidy Program

- Increase in quality and training for child care centres serving up to 1,750 children

New Brunswick

- As many as 300 facilities will be transformed into designated early learning centres, resulting in some 9,900 children benefitting from low-fee child care

Nova Scotia

- Families in harder-to-reach communities will have greater access to affordable child care through the creation of 15 new child care centres, 500 new child care spaces, and 90 new family day care sites

Nunavut

- All 39 centres and as many as 210 educators in Nunavut will benefit from Territory-wide training and as many as 838 children will benefit from continued access to child care spaces

Ontario

- Up to 100 new Ontario Early Years Child and Family Centres will be created, supporting as many as 100,000 more child and family drop-in visits

- Up to 11,200 children will be supported through additional fee subsidies or equivalent financial supports

Prince Edward Island

- Up to 100 children whose parents work non-standard or seasonal hours and can receive specialized child care tailored to their needs

- Up to 200 infants and preschool children will be able to access a regulated space (10 per cent increase)

Yukon

- Support 90 per cent of child care centres in maintaining fees without increasing costs to parents

British Columbia

- The province is developing prototype centres to test the introduction of universal child care. Children across the province will have access to low-cost infant and toddler spaces at significantly reduced parent fees, including children from low-income families benefiting from free child care

Manitoba

- An estimated 1,400 more affordable child care spaces will be created to support lower-income, French-language and newcomer families, as well as underserved communities

The Government is also partnering with Indigenous organizations to engage with Indigenous Peoples across the country to co-develop an Indigenous Early Learning and Child Care Framework. This framework will reflect the unique cultural needs of First Nations, Inuit and Métis Nation children across Canada. A commitment of $360 million, starting in 2017-18, has been made towards the Framework over the next three years.

In addition to bilateral agreements with other levels of government, the Government will also dedicate funding towards specific initiatives to support better outcomes for early learning and child care in Canada. Over the next 11 years, this includes:

- $100 million for early learning and child care innovation, which will support new and innovative practices across the country and help to develop more effective services to improve life outcomes for children and their families.

- $95 million to close data gaps in order to better understand what child care looks like in Canada, supporting strong reporting on progress made in implementing the Multilateral Early Learning and Child Care Framework and the Indigenous Early Learning and Child Care Framework.

Once bilateral agreements with all provinces and territories have been concluded, it is expected that close to 40,000 children could benefit from new subsidized child care spaces over the next three years. This means fewer parents that have to make the difficult choice between working and staying home to raise their families.

Children in the House and Parental Leave for Parliamentarians

Our country is stronger when we empower decision-makers who reflect the diversity of Canada. Part of encouraging the next generation of young women to run for office is demonstrating that our institutions are modern and family-friendly, and that the experiences they bring to the table will contribute to their success.

Supporting Community Women’s Organizations

When women come together, change happens. This is true around the world, and it’s true here in Canada. Across the country, women’s organizations play an important role in raising social awareness and mobilizing communities to change laws, attitudes and social norms.

The Women’s Program provided funding of close to $400,000 to support the City for All Women Initiative, a 36-month project working to improve the economic security of women and girls by addressing the gendered impacts of poverty in Ottawa.

The organization is conducting a Gender-based Analysis Plus to develop recommendations on poverty reduction measures. Key stakeholders are being engaged in identifying strategies to influence policies, practices, services and budgets in Ottawa’s municipal institutions to increase their effectiveness for women and girls.

Created in 1973, the Women’s Program provides funding support for women’s organizations and community-based groups working to implement systemic change through projects at the local, regional and national level. These projects strive to advance gender equality by addressing the following priorities: ending violence against women and girls; improving women’s and girls’ economic security and prosperity; and encouraging more women and girls to reach leadership and decision-making positions.

To support more initiatives that build the capacity of equality-seeking organizations, reduce gender inequality in Canada, and promote a fairer and more productive society, the Government proposes to provide $100 million over five years to Status of Women Canada to enhance the Women’s Program. This investment will increase organizational and sector capacity on a needs basis, allowing organizations to participate in ongoing training, skills development and community engagement, while reducing competition among equality-seeking organizations for funding. This investment will also ensure better funding for organizations focused on vulnerable women, including groups such as Indigenous women, women with disabilities, members of the LGBTQ2 communities, and newcomer and migrant women.

A National Conversation on Gender Equality With Young Canadians

Gender-based Analysis Plus (GBA+) is a tool used to assess how diverse groups of women, men and gender-diverse people may experience policies, programs and initiatives. The “plus” in the gender-based analysis is an acknowledgment that we need to go beyond sex and gender differences as we have multiple identity factors that intersect and inform who we are, including race, ethnicity, sexuality, religion, age and mental or physical ability. Facilitating a national dialogue on the importance of integrating GBA+ in the development of public policies, programs and initiatives is expected to strengthen analytical capacity across the country and provide a means of sharing results and best practices. To this end, the Government proposes to provide Status of Women Canada with $1.3 million in 2018–19 to host a national roundtable on GBA+. The Government also proposes to provide Status of Women Canada with additional funding of up to $7.2 million over five years to lead a national conversation on gender equality with young Canadians.

Engaging Men and Boys to Promote Gender Equality

Gender equality is not just about women and girls. That is why the Government of Canada will introduce a strategy focused on men and boys. The Government will provide $1.8 million over two years to Status of Women Canada to develop an engagement strategy for men and boys that promotes equality and pilots innovative, targeted approaches to addressing inequality. Few governments have a strategy focused on men and boys as part of their work to create a more egalitarian society; investing in this effort would make Canada a world leader in this area.

Men and boys have a vital role in creating workplaces that are free of discrimination and in helping to build a society where harassment and gender-based violence are no longer tolerated. They must be part of the solution. At the same time, men and boys also have gendered intersecting identities and experience inequality, and are not all a homogenous group. This work will recognize that gender is not synonymous with women.

Evidence-Based Policy

In order to properly address gender inequality and track our progress towards a more equitable society, we need to better understand the barriers different groups face. The Government of Canada intends to address gaps in gathering data and to better use data related to gender and diversity. This includes proposing $6.7 million over five years, starting in 2018–19, and $0.6 million per year ongoing, for Statistics Canada to create a new Centre for Gender, Diversity and Inclusion Statistics. The Centre will maintain a public facing GBA+ data hub to support evidence-based policy development and decision-making—both within the federal government and beyond.

The Centre will work to address gaps in the availability of disaggregated data on gender, race and other intersecting identities to enrich our understanding of social, economic, financial and environmental issues. The work conducted at the Centre will include collecting, analyzing and disseminating data on visible minorities to understand the barriers different groups face and how best to support them with evidence-based policy.

As part of the Government’s commitment to address gaps in gender and diversity data, the Government is also proposing to provide $1.5 million over five years, starting in 2018–19, and $0.2 million per year ongoing, to the Department of Finance Canada to work with Statistics Canada and Status of Women to develop a broader set of indicators and statistics to measure and track Canada’s progress on achieving shared growth and gender equality objectives.

Budget 2018 also proposes to provide $5 million per year to Status of Women Canada to undertake research and data collection in support of the Government’s Gender Results Framework. One of the first projects this would support is an analysis of the unique challenges visible minority and newcomer women face in finding employment in science, technology engineering and mathematics occupations. This research will fill important gaps in knowledge as to how to achieve greater diversity and inclusion among the high-paying jobs of tomorrow.

Recognizing the importance of poverty data in evidence-based decision-making by all levels of government, the federal government additionally proposes an investment of $12.1 million over five years, and $1.5 million per year thereafter, to address key gaps in poverty measurement in Canada. This includes ensuring that poverty data is inclusive of all Canadians, data on various dimensions of poverty are captured, and the data is robust and timely.

Skills for Tomorrow’s Economy

Our economy is evolving rapidly, with new opportunities and technologies driving growth and reshaping the world of work. To make the most of these emerging opportunities, governments, employers and workers must work together to ensure Canadian workers have the skills they need to succeed in an evolving economy.

Canada Summer Jobs 2019–20

A summer job helps students pay for their education, and gives them the work experience they need to find and keep a full-time job after they graduate. Starting in Budget 2016, the Government supported an additional 35,000 summer jobs under the Youth Employment Strategy’s Canada Summer Jobs program. The Government proposes to provide an additional $448.5 million over five years, starting in 2018–19, to the Youth Employment Strategy. This funding will support the continued doubling of the number of job placements funded under the Canada Summer Jobs program in 2019-20 and provide additional resources for a modernized Youth Employment Strategy in the following years, building on the input of the Expert Panel on Youth Employment. A renewed Youth Employment Strategy will be announced over the course of the next year.

Improving the Quality of Career Information and Program Results

Better information leads to better outcomes. The Government of Canada is investing in a digital platform to provide the accurate and up-to-date information Canadians need to make informed career decisions, including how much money they can expect to earn in a given field and what skills are in demand by employers. The Government proposes to invest up to $27.5 million over five years, starting in 2018–19, and $5.5 million per year ongoing, from Employment and Social Development Canada’s existing resources, to support an Education and Labour Market Longitudinal Linkage Platform. This secure data platform, which will be housed within Statistics Canada, will help to better track and make available important labour market information. The information will be accessible to everyone, and will be used to monitor government programs to ensure they are achieving their objectives.

Making Employment Insurance More Responsive and Effective

The Employment Insurance (EI) program is an important support for Canadian workers, providing temporary income support to people who have lost their job or have to be absent from work for an extended period of time. In addition to improving the design of parental benefits, Budget 2018 proposes a number of measures to make EI supports more responsive to the needs of Canadians who are dealing with major life events.

Improving Working While on Claim

The EI Working While on Claim pilot project allows claimants to keep 50 cents of their EI benefits for every dollar they earn, up to a maximum of 90 per cent of the weekly insurable earnings used to calculate their EI benefit amount. This pilot project is scheduled to expire in August 2018. The Government proposes to introduce amendments to the Employment Insurance Act to make the current EI Working While on Claim pilot rules permanent, providing $351.9 million over five years, starting in 2018–19, and $80.1 million per year ongoing. The legislation will also include a provision to grandfather claimants who have chosen, under the current pilot project, to revert to more flexible rules of a previous pilot project introduced in 2005. Claimants will be able to continue to do so for up to three years, until August 2021.

While these provisions already apply to parental and caregiving benefits, they do not currently apply to maternity and sickness benefits. In these instances, Canadians who wish to stage their return to work after an illness or the birth of a child have limited flexibility to do so without jeopardizing their EI benefits. Extending the Working While on Claim pilot provisions to EI maternity and sickness benefits will enable greater flexibility so Canadians can keep more of their EI benefits when they need them most.

Helping Workers in Seasonal Industries

For most Canadians losing a job is a temporary, one-time occurrence. The length of time it takes to find a new job will depend on the circumstances of each individual and the local job market they face at a particular point in time. This is why EI provides benefits that vary depending on the regional unemployment rate.

However, a number of Canadians also work in jobs like tourism and fish processing which fluctuates by season. Because EI benefits vary from year to year in each region, this dynamic can cause disruption for workers whose main jobs are seasonal. For those who are not able to find alternative employment until the new season begins, this can represent a challenging and stressful loss of income, especially if EI benefits vary significantly from year to year.

To test new approaches to better assist workers most affected by these circumstances, Budget 2018 proposes to invest $80 million in 2018–19 and $150 million in 2019–20 through federal-provincial Labour Market Development Agreements. In the coming months, the Government will work with key provinces to co-develop local solutions that can be tested to support workforce development. This builds on short-term actions the Government is already taking in collaboration with key provinces to address this challenge this fiscal year. In addition, Employment and Social Development Canada will reallocate $10 million from existing departmental resources to provide immediate income support and training to affected workers. These measures will help ensure that unemployed workers in Canada’s seasonal industries have access to the supports they need when they need them most.

Budget 2018 proposes legislative amendments, as required, to assist workers in seasonal industries.

Improving Access to the Canada Learning Bond

Education and training are the keys to finding and keeping good jobs. The Canada Learning Bond and Canada Education Savings Grant are contributions that the Government of Canada makes to Registered Education Savings Plans (RESPs) to help Canadians save for a child’s education after high school. Through these tools, the Government of Canada is helping to make education more affordable and accessible.

Building on Budget 2017 measures, the Government of Canada is working with the Province of Ontario to integrate RESP referrals into the Ontario online birth registration service. This means more children from low-income families will be able to access the Canada Learning Bond.

Parents will be able to open an RESP at the same time as they apply for other services under the Ontario online birth registration service. Once an RESP is open, eligible children may begin to receive the Canada Learning Bond to help support future studies at a trade school, college or university, or in an apprenticeship program—without any contributions required by their parents or others.

Labour Market Transfer Agreements

Through Budget 2017, the Government made significant additional investments of $2.7 billion over six years, beginning in 2017–18, in Labour Market Transfer Agreements with provinces and territories to help Canadians prepare, find, advance in, and keep good jobs. These investments help improve skills training and employment supports for unemployed and underemployed Canadians. This means that more Canadians—including those who face significant barriers to employment—will get access to the training and supports they need to earn more money, improve their job security and succeed in a changing economy. The new agreements also give additional flexibility to provinces and territories to address their own needs, to expand eligibility and to focus on outcomes.

To build a strong, flexible and resilient labour force, Budget 2018 proposes to:

- Give young Canadians valuable work experience, by continuing to double work placements through the Canada Summer Jobs program. To this end, Budget 2018 proposes to invest an additional $448.5 million over five years, starting in 2018–19, in the Youth Employment Strategy.

- Provide information to Canadians about the relationship between careers and skills, so that they are well-equipped to make smart education and employment decisions. Budget 2018 proposes to invest $27.5 million over five years, starting in 2018–19, and $5.5 million per year ongoing, from Employment and Social Development Canada’s existing resources, towards creating an Education and Labour Market Longitudinal Linkage Platform.

- Legislate the current Employment Insurance (EI) Working While on Claim pilot rules and expand them to EI maternity and sickness benefits, so that workers can maintain their connection to the labour force during periods of temporary unemployment. Budget 2018 proposes to invest $351.9 million over five years, starting in 2018–19, and $80.1 million per year ongoing, to meet this objective.

- Provide an additional $230 million over two years, starting in 2018–19, through the Labour Market Development Agreements to co-develop local solutions to unique challenges faced by workers in seasonal industries.

Progress on Lifelong Learning

Canadians’ overall approach to learning has changed. At one time, Canadian workers could expect to train for a good, well-paying job and then keep a single job through to retirement. Today, workers and employers alike are challenged to keep pace with evolving technologies and rising competition. Canadians today must approach learning as a lifelong commitment, and the Government of Canada is working hard to support this.

The Government continues to make progress on its Budget 2017 commitments to enhance student aid for adult learners. It has expanded eligibility for Canada Student Grants and Loans for part-time students and for full- and part-time students with children, and introduced a three-year pilot project that will provide adults returning to school on a full-time basis after several years in the workforce with an additional $1,600 in grant funding per school year. The pilot will also make it easier for adult full-time students to qualify for grants given their drop in income while they are in school. Canadians will be able to benefit from these measures starting August 1, 2018.

The Government has also made it possible for more youth to gain work experience by doubling the number of placements under Canada Summer Jobs. This has resulted in nearly 70,000 students per year getting hands-on work experience through summer employment and generating income for their post-secondary education. In this way, the Government has supported more youth—many of whom would not otherwise have found equivalent work experience—save approximately one-third of their educational expenses for the following school year, and gain key skills needed for employability.

The Government has also made progress with provincial and territorial partners to promote and expand the use of Employment Insurance (EI) flexibilities to ensure that unemployed adults who pursue self-funded training are able to keep their El benefits. Together, these measures will help Canada's workers to improve their skills and upgrade their credentials throughout their working lives, positioning them to benefit from and contribute to shared economic growth.

Helping Women Enter and Succeed in the Trades

There is a substantial gender gap in apprenticeship training, with women accounting for only 11 per cent of new registrants in interprovincially recognized Red Seal skilled trades.

This pattern of women's under-participation in higher-paid, male-dominated trades has meant that women are not only comparatively underpaid in the trades sectors, but also wrongly perceived as uninterested in or incapable of pursuing careers in the higher-paid male-dominated fields.

To encourage women to pursue careers in male-dominated—and better-paid—Red Seal trades, and to ensure that women are increasingly able to model leadership to other aspiring female tradespeople, the Government is allocating $19.9 million over five years, starting in 2018–19, to pilot an Apprenticeship Incentive Grant for Women. Under the Grant, women in male-dominated Red Seal trades would receive $3,000 for each of their first two years of training (up to $6,000). This, in combination with the existing Apprenticeship Completion Grant valued at $2,000, will result in a combined $8,000 in support over the course of their training for a female apprentice training to become a welder, machinist pipe fitter or any other skilled trade that is male-dominated. Nearly 90 per cent of Red Seal trades would be eligible for the Grant.

The Red Seal Program is the Canadian standard of excellence for skilled trades. Formally known as the Interprovincial Standards Red Seal Program, it sets common standards to assess the skills of tradespersons across Canada. Tradespersons who meet the Red Seal standard receive a Red Seal endorsement on their provincial or territorial trade certificates.

There are currently 56 designated Red Seal trades, ranging from bakers to welders, and agriculturalists to hairstylists.

Red-Seal.ca

Pre-Apprenticeship Program

Understanding the value and promise of careers in the skilled trades, and the importance of these professions to Canada as a whole, the Government of Canada is also proposing to introduce a new Pre-Apprenticeship Program. This program will encourage underrepresented groups—including but not limited to women, Indigenous Peoples, newcomers and persons with disabilities–to explore careers in the skilled trades. Working in partnership with provinces, territories, post-secondary institutions, training providers, unions and employers, the Pre-Apprenticeship Program will help Canadians explore the trades, gain work experience, make informed career choices and develop the skills needed to find and keep good, well-paying jobs in the trades. The Government will provide $46 million over five years, starting in 2018–19, and $10 million per year thereafter, for the Pre-Apprenticeship Program.

Women in Construction Fund

In addition to the above measures, the Government will be launching the Women in Construction Fund in 2018–19, with an investment of $10.0 million over three years from Employment and Social Development Canada’s existing resources. The Program will build on existing models that have proven to be effective in attracting women to the trades. These models provide supports such as mentoring, coaching and tailored supports that help women to progress through their training and find and retain jobs in the trades.

The Government has also launched the new Union Training and Innovation Program. A key component of this Program is to support women to enter and succeed in the trades. Projects are now starting to roll out and most are aimed specifically at increasing the participation and success of women in the trades.

Getting Into and Staying in the Workforce and Career Pathways for Visible Minority Newcomer Women in Canada

Fawzia immigrated to Canada in 2009 from Somalia, where she was a practicing gynecologist/obstetrician. After spending a year attempting to get recertified to practice medicine in Canada, she decided to volunteer at a local hospital, where she spends her time helping escort patients between departments. She loves being back in a hospital setting but misses being able to care for her own patients one-on-one, and worries about losing the practical skills that are an important part of her profession.

Employment is key to the successful integration of newcomers to Canada, supporting their financial independence and allowing them to make social connections and retain and build job skills. However, newcomers sometimes face significant barriers to finding and keeping good jobs, including language challenges, lack of Canadian experience, a lack of social networks and, in some cases, discrimination. For many visible minority newcomer women, there are additional barriers, including both gender- and race-based discrimination, precarious or low-income employment, lack of affordable and accessible child care, lower language and literacy levels, lack of community and social supports, and limited or interrupted education in their home country. To help reduce these barriers, the Government will launch a three-year pilot to support programming for newcomer women who are also members of visible minorities and provide $31.8 million over three years starting in 2018–19.

Helping Vulnerable People Access Government Funding

The Government of Canada provides grants and contributions funding to organizations across the country that deliver social services to Canadians. These organizations often serve our country’s most vulnerable people, including Indigenous Peoples, newcomers and persons with disabilities, providing them with supports to improve basic skills and language proficiency and achieve foreign credential recognition. However, many of these organizations do not have the organizational capacity to pursue government contracts or maximize available funding opportunities. Recognizing the importance of the work that these organizations undertake, the Government will reallocate $7.8 million over five years, beginning in 2018–19, from Employment and Social Development Canada’s existing resources, to help community organizations build this capacity.

Investing in Skills for the Future

Keeping up with future skills needs is a daunting task for Canadian workers, employers, governments and educational leaders. The Government recognizes that innovative approaches are needed to take advantage of emerging opportunities, technologies and trends and ensure that middle class Canadians benefit from economic growth.

Since 2016, the Advisory Council on Economic Growth has provided expert advice to the Government on policy actions that can be taken to help create the conditions for strong and sustained long-term economic growth. In February 2017, the Advisory Council released their second report, calling on the Government of Canada to build a highly skilled and resilient workforce by investing in a FutureSkills Lab. To this end, Budget 2017 committed $225 million over four years, starting in 2018–19, and $75 million per year thereafter, to establish a new organization tasked with identifying the skills sought and required by employers, exploring new and innovative approaches to skills development, and sharing information to inform future investments and programming.

Working with provinces and territories, the private sector, educational institutions and not-for-profit organizations, the Government will launch Future Skills this spring. Future Skills will bring together expertise from all sectors and leverage experience from partners across the country. It will also include an independent Council to advise on emerging skills and workforce trends, and a research lab focused on developing, testing and rigorously measuring new approaches to skills assessment and development.

Figure 1.3: Preparing Canada’s Labour Force for the Skills of Tomorrow

Horizontal Skills Review

From basic literacy and numeracy support to specific skilled trades training to financial supports and work experiences offered to students, the Government provides a wide range of skills programming to meet a variety of needs. To maximize the effectiveness of these programs, particularly in the way that they offer support to workers wishing to take advantage of emerging opportunities, the Government will undertake a horizontal review of skills programming over the next year. In support of this review, the Government proposes to provide $0.75 million in 2018–19 to the Treasury Board Secretariat. This, in conjunction with the Future Skills organization, will provide Canada’s labour force with the information and training needed to meet future challenges and opportunities head on.

Strengthening and Diversifying Trade

Canada’s economic success rests not only on the hard work of Canadians, but also on strong trade relationships in an increasingly globalized world. Canada is—and always has been—a trading nation, and Canadians recognize that done properly, trade can be a positive force for change. It can drive economic growth, create good, well-paying jobs for the middle class, and open up opportunities for Canadian businesses to grow and expand.

To ensure that trade benefits Canadians, and to ensure that those benefits are felt by everyone, the Government is:

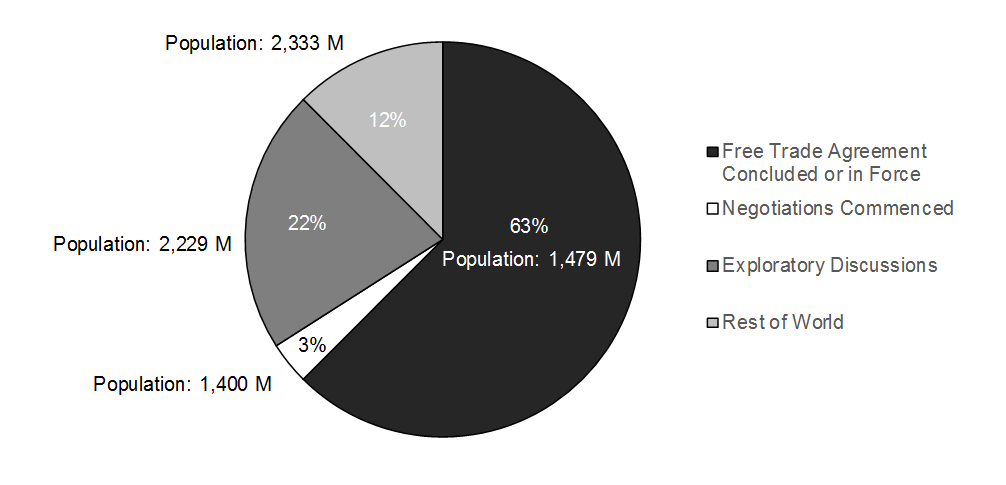

- Actively deepening trade relationships, through modern, progressive free trade agreements in North America, Europe and new, fast-growing markets in Asia. As a result of the recently concluded Canada-European Union Comprehensive Economic and Trade Agreement (CETA) and Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), preferential market access for Canadian goods and services abroad has more than doubled, from 31 per cent to 63 per cent of world gross domestic product (GDP).

- Making new, transformative enhancements to Canada’s export programs to help Canadian businesses find customers around the world.

- Ensuring that trade is done responsibly, in a rules-based way.

Modernizing the North American Free Trade Agreement

Since its inception in 1994, the North American Free Trade Agreement (NAFTA) has been a significant contributor to growth and jobs in Canada, the United States and Mexico, improving the lives of workers and families in all three partner countries. Our combined trading relationship has increased three-fold in that time, and is now worth approximately US$1 trillion each year.

Under NAFTA, North America has become the biggest, most comprehensive economic bloc in the world, comprising a quarter of the world’s GDP, with only seven per cent of its population.

Our inter-connected supply chains mean Canadians, Americans and Mexicans not only sell to one another; we build things together and sell them to the world.

While economic gains under the agreement have been positive for all three countries, NAFTA requires an update. It should be modernized for the 21st century, to ensure the benefits of trade are shared more broadly, with more people.

That’s why we are working hard to renegotiate an updated and improved North American Free Trade Agreement that is win-win-win—one that will foster greater opportunity for the middle class, and those working hard to join it, in Canada, the United States and Mexico.

We will always uphold and defend Canadians’ interests and values. The Government of Canada is committed to reaching a good deal.

Europe

The Government is also looking beyond North America, to establish closer trade relationships with large and emerging markets.

In Europe, this has meant the delivery of CETA. As of September 2017, all significant parts of the agreement have been brought into force, deepening our ties with the world’s second-largest single-market economy and providing Canadian businesses with unprecedented access to a market of 500 million people, with a GDP of $22 trillion.

With commitments on labour rights, environmental protection, sustainable development and cultural diversity, CETA represents a model for a modern and progressive trade agreement.

Asia-Pacific

The Government is also actively pursuing trade opportunities for Canada in the fast-growing Asia-Pacific region.

One landmark achievement is the recently concluded CPTPP, which, together with the Canada-Korea Free Trade Agreement that came into force in 2015, will solidly anchor Canada’s place in the Asian market.

The CPTPP, the largest regional trade deal in history, will establish a network of open markets in the Asia-Pacific region, representing 495 million people with a combined GDP of $13.5 trillion. This includes important Asian markets such as Japan, Malaysia and Vietnam, with significant potential for further growth over time as additional countries join the agreement.

In addition to opening markets, the Government worked hard to ensure that the CPTPP safeguards the importance of preserving cultural identity and diversity, and promoting corporate social responsibility, gender equality and Indigenous rights. It also enshrines the strongest labour and environmental provisions of any trade deal in history.

As it pursues new opportunities for trade, the Government will work with key sectors—such as the auto sector and supply managed sectors—to evaluate the potential economic impacts of trade agreements, and ensure these key sectors remain strong and competitive.

Pursuing New Markets

In addition to NAFTA, CETA and the CPTPP, the Government is continuing to pursue other opportunities for free trade agreements around the world, including ongoing exploratory talks with China, and discussions with a number of important partners, and regional groupings such as the Pacific Alliance (Chile, Colombia, Mexico and Peru), MERCOSUR (Argentina, Brazil, Paraguay and Uruguay) and the Association of Southeast Asian Nations (ASEAN).

Canada's Free Trade Network

(based on percentage of world GDP)

As a further accelerator for more exports to Asia, the Government will be making targeted enhancements to its export programming for the region. In particular, this new strategy aims to develop stronger bilateral relations with China—Canada’s second-largest single-nation trading partner—in order to create more jobs in Canada through expanded trade. Canada and China have a shared goal of doubling bilateral trade by 2025.

The Government proposes to provide up to $75 million over five years, starting in 2018–19, with $11.8 million per year thereafter, to Global Affairs Canada to establish a stronger Canadian diplomatic and trade support presence in China and Asia. This includes bolstering the number of Canadian diplomats and trade commissioners on the ground in China as well as new initiatives to promote Canada’s trade with China and other Asian markets.

Ensuring Rules-Based and Responsible Trade

As we seek to open up markets around the world, we also need to support domestic industries in the wake of trade actions, and need to take steps to ensure a robust rules-based trading system that balances the interests of Canadian stakeholders at home and abroad.

To that end, the Government is committed to supporting and defending the Canadian forest industry in the face of unjustified U.S. duties. The Government proposes to provide $191 million over five years, starting in 2018–19, to Global Affairs Canada and Natural Resources Canada to support softwood lumber jobs, including through litigation under the World Trade Organization and the NAFTA dispute settlement mechanisms. The Government will also continue its negotiating efforts towards a durable softwood lumber agreement with the U.S. that will bring stability on both sides of the border.

The Government has also taken steps in recent years, including through amendments to the Special Import Measures Act, to ensure that the trade remedy system is effective and fair. In light of the essential function that the Canadian International Trade Tribunal performs in Canada’s trade remedy system, the Government proposes to amend the Canadian International Trade Tribunal Act to ensure that it continues to effectively deliver on its mandate. In addition, the Government recently reviewed the level of anti-dumping duties applied to imports of gypsum board from the U.S., and has concluded that they are preventing injury to domestic producers while ensuring adequate supply in the market. The Government will continue to monitor this situation to ensure the duties are having the intended effect.

Because it believes that trade is best when it works for everyone, the Government has announced it is creating an independent Canadian Ombudsperson for Responsible Enterprise. This represents a new global standard in promoting responsible business conduct. The Ombudsperson will work to ensure that Canadian firms operating abroad exercise leadership in ethical, social and environmental practices. Funding of $6.8 million over six years, starting in 2017–18, with $1.3 million per year thereafter, will be provided for this initiative.

A Fair Tax System for All Canadians

When middle class Canadians have more money to invest, save and grow the economy, all Canadians benefit. That’s why our first substantial piece of legislation was to restore fairness to Canada’s tax system, by raising taxes on the wealthiest one per cent, so that we could cut taxes for the middle class.

To have an economy that works for everyone, we need a tax system that is fair, and we need all Canadians to pay their fair share. After all, the taxes we pay as Canadians build the infrastructure that gets our goods to market, and helps create good, well-paying jobs. The taxes we pay help to set broken bones, and push cancer into remission. And the taxes we pay mean that if a hard-working Canadian loses her job, she might not have to lose her house.

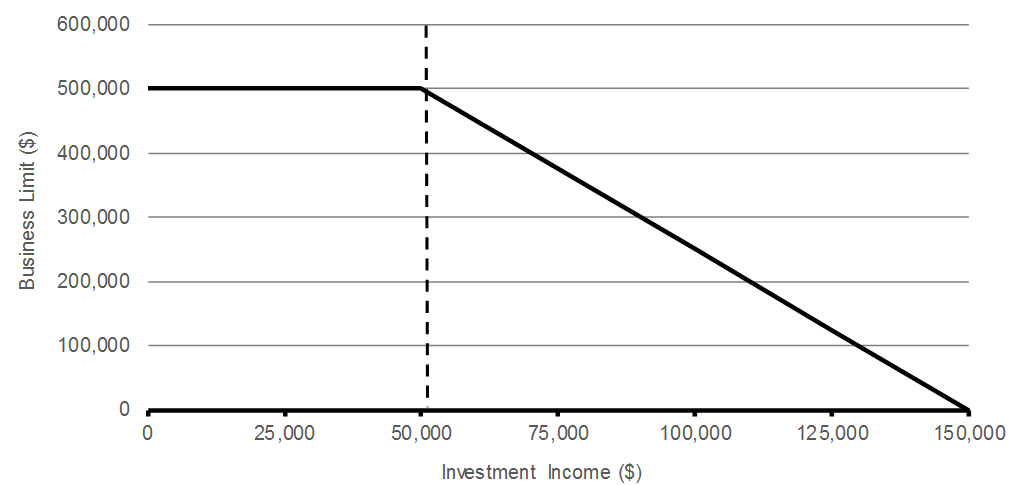

Delivering the programs and services that Canadians need, while keeping taxes low for small businesses and middle class families, is important to this Government, and to all Canadians.