Chapter 1 - Investing in the Middle Class

From young families taking steps toward homeownership to experienced workers stepping up to embrace new challenges to seniors transitioning into retirement free of worries, a strong middle class is at the heart of Canada's economy, and the key to this country's continued success.

One of the best ways to grow the economy is to invest in the middle class.

That means more money for hard-working families. This helps to make life more affordable, drives consumer demand, and gives businesses the confidence they need to invest in creating more good, well-paying jobs.

Investing in the middle class means taking steps to ensure that more Canadians can afford a place to live that is safe and secure—a place they can be proud to call home.

Investing in the middle class also means preparing for the challenges of today and tomorrow—helping people get the skills they need to find and keep a good job, or get the retraining that will help secure work for years to come.

It means ensuring that more Canadians have access to a secure and dignified retirement after a lifetime of hard work.

And it means making sure that people have access to the medicine they need to stay healthy.

In Budget 2019, the Government remains squarely focused on investing in the middle class—introducing new measures that will help build an economy that works for everyone now, and for the long term.

Part 1: An Affordable Place to Call Home

Every Canadian deserves a safe and affordable place to call home. Yet for many Canadians finding an affordable place to call home is a challenge, especially in some of Canada's largest cities where the rising costs of living, limited housing supply and strong population growth have pushed home purchase and rental costs beyond what many people can afford.

Although rising house prices and a limited supply can make housing affordability a challenge across the board, young, middle class families are especially worried about their prospects for homeownership. The majority of young people who don't own a home view a home purchase as a good investment, based on recent surveys. Yet rather than buying a home early in their working lives as their parents and grandparents could, young people often find themselves unable to enter the housing market, and are forced to delay their dream of home ownership.

Elevated house prices also have spillover effects—making rents more expensive and boosting demand for community and subsidized housing. This has created serious affordability challenges for Canadians in different living situations, from people looking to buy or rent houses to individuals and families living in community housing. Today, one in eight Canadian households cannot find affordable housing that is safe, suitable and well-maintained. That is why the Government introduced the National Housing Strategy in Budget 2017.

The Government is committed to a comprehensive plan supporting housing affordability, in particular for those who are finding it increasingly difficult to purchase their first home.

To that end, Budget 2019 proposes a number of measures, to:

- Make housing more affordable today by reducing barriers to homeownership for first-time home buyers.

- Boost supply in Canada's housing and rental markets.

- Increase fairness in the real estate sector.

Budget 2019's proposed measures would build on the Government's previous investments to enhance housing affordability for those who need it most through the National Housing Strategy.

Improving Affordability Today: Support for First-Time Home Buyers

Budget 2019 proposes to introduce targeted support for first-time home buyers, while maintaining the prudent safeguards that protect consumers and promote responsible home purchase decisions.

Introducing the First-Time Home Buyer Incentive

Saving enough for a down payment on a home and managing the monthly costs of homeownership can be challenging—especially for first-time home buyers, many of whom are trying to establish or advance their careers, raise young families, or even relocate to a new community.

To help make homeownership more affordable for first-time home buyers, Budget 2019 proposes to introduce the First-Time Home Buyer Incentive. The Incentive utilizes a unique financing model that has been used by affordable housing associations and non-profits in Canada and elsewhere. The Incentive enables home buyers to reduce the amount of money required from an insured mortgage without increasing the amount they must save for a down payment. Through the First-Time Home Buyer Incentive, Canada Mortgage and Housing Corporation (CMHC) would provide up to $1.25 billion over three years (starting in 2019–20) to eligible home buyers by sharing in the cost of a mortgage. As a means-tested program, the Incentive would target Canadians that face legitimate challenges entering housing markets.

To help make homeownership more affordable for first-time home buyers, Budget 2019 proposes to introduce the First-Time Home Buyer Incentive. The Incentive utilizes a unique financing model that has been used by affordable housing associations and non-profits in Canada and elsewhere. The Incentive enables home buyers to reduce the amount of money required from an insured mortgage without increasing the amount they must save for a down payment. Through the First-Time Home Buyer Incentive, Canada Mortgage and Housing Corporation (CMHC) would provide up to $1.25 billion over three years (starting in 2019–20) to eligible home buyers by sharing in the cost of a mortgage. As a means-tested program, the Incentive would target Canadians that face legitimate challenges entering housing markets.

What Is the CMHC First-Time Home Buyer Incentive?

The CMHC First-Time Home Buyer Incentive is a shared equity mortgage that would give eligible first-time home buyers the ability to lower their borrowing costs by sharing the cost of buying a home with CMHC. The Incentive would provide funding of 5 or 10 per cent of the home purchase price. No ongoing monthly payments are required. The buyer would repay the Incentive, for example at re-sale.

For example, if a borrower purchases a $400,000 home with a 5 per cent down payment and a 5 per cent CMHC shared equity mortgage ($20,000), the size of the borrower's insured mortgage would be reduced from $380,000 to $360,000, helping to lower the borrower's monthly mortgage bill. This would make it easier for Canadians to buy homes they can afford.

How the First-Time Home Buyer Incentive Would Work

Eligible first-time home buyers who have the minimum down payment for an insured mortgage would apply to finance a portion of their home purchase through a shared equity mortgage with CMHC.

The Incentive would reduce the monthly payments required to buy a home. This would give first-time home buyers greater flexibility both in purchasing a home and managing its ongoing costs. With a shared equity mortgage, first-time home buyers would save money every month, giving them more money to pay down their insured mortgage sooner or for other priorities.

CMHC would offer qualified first-time home buyers a 10 per cent shared equity mortgage for a newly constructed home or a 5 per cent shared equity mortgage for an existing home. This larger shared equity mortgage for newly constructed homes could help encourage the home construction needed to address some of the housing supply shortages in Canada, particularly in our largest cities.

The First-Time Home Buyer Incentive would include eligibility criteria to ensure that the program helps those with legitimate needs while ensuring that participants are able to afford the homes they purchase. The Incentive would be available to first-time home buyers with household incomes under $120,000 per year. At the same time, participants' insured mortgage and the Incentive amount cannot be greater than four times the participants' annual household incomes.

Shared equity mortgages are currently offered by non-profit and other providers in some regions. Budget 2019 proposes to establish a fund to assist providers of shared equity mortgages, helping eligible Canadians achieve affordable homeownership. The fund, to be administered by CMHC, would provide up to $100 million in lending to shared equity mortgage providers over a five-year period, starting in 2019–20, to help existing shared equity mortgage providers scale-up their business and encourage new players to enter the market.

Shared equity mortgages are currently offered by non-profit and other providers in some regions. Budget 2019 proposes to establish a fund to assist providers of shared equity mortgages, helping eligible Canadians achieve affordable homeownership. The fund, to be administered by CMHC, would provide up to $100 million in lending to shared equity mortgage providers over a five-year period, starting in 2019–20, to help existing shared equity mortgage providers scale-up their business and encourage new players to enter the market.

The Government will propose legislation that would enable CMHC to offer the First-Time Home Buyer Incentive and administer a fund for third-party shared equity mortgage providers. More details about CMHC's First-Time Home Buyer Incentive and funds to assist other providers of shared equity mortgages will be released later this year, with the programs expected to be operational by September 2019.

The First-Time Home Buyer Incentive: A New, More Affordable Path to Homeownership

Anita is seeking to buy a new condo in Ajax, Ontario for $400,000. Under the First-Time Home Buyer Incentive, Anita can apply to receive $40,000 in a shared equity mortgage (10 per cent of the cost of a new home) from CMHC, lowering the total amount she needs to borrow.

Compared with an insured mortgage, the CMHC First-Time Home Buyer Incentive would enable Anita to pay $228 less in mortgage payments every month. Anita can use these savings to invest in her future, such as buying a home better suited to her needs, paying down her insured mortgage sooner, or having more monthly disposable income, e.g., to pay for a more convenient option for child care. When Anita sells her condo in the future, CMHC is repaid.

| Insured Mortgage Model (No Incentive) | CMHC First-Time Home Buyer Incentive Model | ||

|---|---|---|---|

| House Price | $400,000 | House Price | $400,000 |

| Down payment | $20,000 (5%) | Down payment | $20,000 (5%) |

| CMHC First-Time Home Buyer Incentive | $40,000 (10%) | ||

| Insured Mortgage | $380,000 (95%) | Insured Mortgage | $340,000 (85%) |

| Monthly carrying cost* | $1,973 | Monthly carrying cost* | $1,745 |

Modernizing the Home Buyers' Plan

To help with the down payment and costs associated with the purchase of a first home, the Home Buyers' Plan (HBP) allows first-time home buyers to withdraw up to $25,000 from their Registered Retirement Savings Plan (RRSP) to purchase or build a home, without having to pay tax on the withdrawal.

Unlike regular RRSP withdrawals, HBP withdrawals are not added to a person's income when withdrawn. Instead, the HBP withdrawals must be repaid over a 15-year period or included in the individual's income if not repaid.

The HBP maximum withdrawal amount—currently $25,000—has not been adjusted for 10 years.

To provide first-time home buyers with greater access to their RRSP savings to purchase or build a home, Budget 2019 proposes to increase the Home Buyers' Plan withdrawal limit to $35,000. This would be available for withdrawals made after March 19, 2019.

To provide first-time home buyers with greater access to their RRSP savings to purchase or build a home, Budget 2019 proposes to increase the Home Buyers' Plan withdrawal limit to $35,000. This would be available for withdrawals made after March 19, 2019.

Alex and Michelle are a young couple living in Toronto where high home prices have put their goal of homeownership further from reach. With the increased HBP withdrawal limit, they will be able to withdraw up to $35,000 each from their RRSPs, for a total of $70,000, allowing them to contribute more toward their down payment, making home ownership possible.

For Canadians who have experienced a breakdown in their marriage or common-law partnership, it can be difficult to keep the family home under new and more challenging financial circumstances.

To help Canadians facing this challenging life event maintain homeownership, Budget 2019 also proposes that individuals that experience the breakdown of a marriage or common-law partnership be permitted to participate in the Home Buyers' Plan, even if they do not meet the first-time home buyer requirement. This measure would be available for withdrawals made after 2019.

To help Canadians facing this challenging life event maintain homeownership, Budget 2019 also proposes that individuals that experience the breakdown of a marriage or common-law partnership be permitted to participate in the Home Buyers' Plan, even if they do not meet the first-time home buyer requirement. This measure would be available for withdrawals made after 2019.

Increasing the HBP withdrawal limit to $35,000 and extending access to individuals who experience the breakdown of a marriage or common-law partnership is estimated to reduce federal revenues by $145 million over five years, starting in 2019–20.

Impact of Mortgage Rate Stress Tests

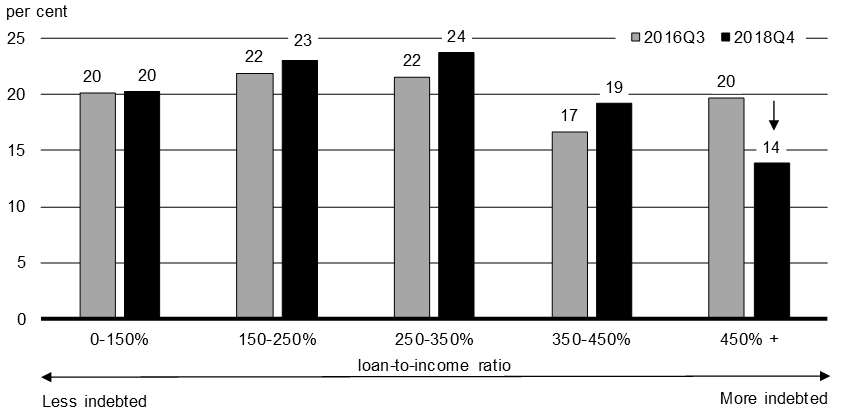

The Government has a responsibility to support a stable housing market and economy. Recent policies introduced by the Government and the Office of the Superintendent of Financial Institutions, the independent federal banking regulator, are helping to ensure that Canadians take on mortgages they can afford, even if interest rates rise or incomes change. The Bank of Canada and other institutions have undertaken analysis outlining how the mortgage interest rate "stress tests" are having their intended impacts. These measures have reduced the number of new home buyers with debt levels that extend well beyond their incomes.

These policies underpin stability for Canada's economy, financial institutions and individual families, benefitting all Canadians. These actions have also contributed to slower growth in house prices and reduced speculation in key areas, helping to limit the amount of debt Canadians must take on to buy a home and improve housing affordability. Nonetheless, household debt remains high, and there continue to be risks in the global economic environment.

The Government continues to closely monitor the effects of its mortgage finance policies—including the stress test for insured mortgages—and would adjust them if economic conditions warrant, to support access to housing while safeguarding financial stability.

Working Together: Increasing Housing Supply Through Partnerships and Targeted Investments

In some of Canada's largest cities, many lower income and middle class Canadians are struggling to find, maintain and afford a good place to live. The reality is that housing supply in Canada's more expensive markets, in particular Toronto and Vancouver, has not grown quickly enough to meet rising housing demand. This lack of supply boosts house and rental prices and makes it more difficult for Canadians to afford housing.

One of the most effective ways to address housing affordability in the long run is to encourage the creation of more housing supply. This will help ensure that house prices grow at a more moderate pace, help keep home ownership or renting more affordable for more Canadians and help keep markets accessible to future generations. Budget 2019 proposes to make long-term investments and collaborate with key partners to boost housing supply in a manner that reflects the housing needs of a broad range of Canadian families. Building more of the right kind of housing supply will keep these Canadian cities livable now and into the future.

Expanding the Rental Construction Financing Initiative

As house prices rise, the rental market is simply not keeping pace with growing demand—especially in large cities where rental vacancy rates hover around one per cent. When demand for limited spaces increases, so too does the average monthly cost of renting. This makes it harder for lower income and middle class Canadians to find an affordable place to live near their work or school, and for future homeowners to save for a down payment.

To help address this challenge, the Government launched the Rental Construction Financing Initiative in 2017—a four-year program that provides low-cost loans for the construction of new rental housing for modest and middle income Canadians. In Budget 2018, the program was enhanced to help build 14,000 new units over the life of the program. To date, applications to the program have been received from every region of Canada. More than 50 projects have been prioritized to receive a loan, and 17 projects, representing 2,000 rental units, have been announced.

To provide more affordable rental options for middle class Canadians, Budget 2019 proposes to provide an additional $10 billion over nine years in financing through the Rental Construction Financing Initiative, extending the program until 2027–28. With this increase, the program would support 42,500 new units across Canada, particularly in areas of low rental supply. On an accrual basis, this represents an investment of $829.5 million over 19 years, starting in 2019–20.

To provide more affordable rental options for middle class Canadians, Budget 2019 proposes to provide an additional $10 billion over nine years in financing through the Rental Construction Financing Initiative, extending the program until 2027–28. With this increase, the program would support 42,500 new units across Canada, particularly in areas of low rental supply. On an accrual basis, this represents an investment of $829.5 million over 19 years, starting in 2019–20.

Rental Construction Financing Initiative

Launched in April 2017, this initiative supports the construction of new rental housing by offering favourable financing rates and terms to developers, relieving pressure in rental markets that are experiencing low vacancy rates. Borrowers must meet minimum requirements for affordability, energy efficiency and accessibility.

Woodman's Grove Residences

Wolfville, Nova Scotia

The federal government is investing close to $8.2 million for the construction of Woodman's Grove Residences. The four-storey building will provide safe and affordable homes to 48 middle class families. All units will have rents at or lower than 30 per cent of median household income in the area. The building will also achieve energy savings of more than 70 per cent and a reduction in greenhouse gas emissions of more than 25 per cent.

Claridge Homes Housing Project

Ottawa, Ontario

The federal government is investing $70.8 million for the construction of a 27-storey building with 227 rental housing units. Over 200 of the new units will have rents lower than 30 per cent of median household income in the area. The project will achieve strong accessibility and energy efficiency outcomes, with more than 10 per cent of units being accessible and projected energy efficiency savings of 50 per cent.

Encouraging Innovation With the Housing Supply Challenge

The issue of housing supply, particularly in Canada's most expensive cities is complex. Not only do Canadians require the right kind of homes to be built, things like the accessibility of schools and daycare, and the proximity to public transit are also factors municipal planners must take into consideration when designing sustainable communities that work well. The Government of Canada can help facilitate the new innovative approaches to accelerate construction approvals and densification that are being developed across the country.

To help municipalities grow housing supply and unlock new solutions for Canadians searching for an affordable place to call home, Budget 2019 proposes to provide $300 million to launch a new Housing Supply Challenge.

To help municipalities grow housing supply and unlock new solutions for Canadians searching for an affordable place to call home, Budget 2019 proposes to provide $300 million to launch a new Housing Supply Challenge.

The Housing Supply Challenge will invite municipalities and other stakeholder groups across Canada to propose new ways to break down barriers that limit the creation of new housing. Successful applicants will be selected and funded through a merit-based competition. The Challenge aims to provide new resources to find new solutions to enhance housing supply and provide a platform to share these models with communities across Canada.

Infrastructure Canada and Canada Mortgage and Housing Corporation will collaborate on the design of the Challenge, with further details to follow by summer 2019.

Launching an Expert Panel on the Future of Housing Supply and Affordability

To make our highest-priced cities affordable for middle class Canadians, governments need to work together to fully understand housing challenges and how best to address them.

On March 15, 2019, the Ministers of Finance for Canada and British Columbia as well as the Minister of Municipal Affairs and Housing for British Columbia came together to launch an Expert Panel on the Future of Housing Supply and Affordability. The Expert Panel will consult with stakeholders to identify and evaluate measures that could build on recent investments and initiatives to increase the supply of housing in British Columbia to meet demand. The Panel will be comprised of leaders and specialists in a range of fields with relevant expertise who will be jointly selected by the governments of Canada and British Columbia in the coming months.

Canada's national housing agency, Canada Mortgage and Housing Corporation, currently conducts and shares housing research and analysis. The Corporation is well-placed to support the Panel's efforts to better understand housing challenges and potential solutions.

Budget 2019 proposes that Canada Mortgage and Housing Corporation invest $4 million over two years to support the work of the Expert Panel on the Future of Housing Supply and Affordability.

Budget 2019 proposes that Canada Mortgage and Housing Corporation invest $4 million over two years to support the work of the Expert Panel on the Future of Housing Supply and Affordability.

To improve efforts to address housing supply, Budget 2019 proposes that Canada Mortgage and Housing Corporation invest $5 million over two years for state-of-the-art housing supply modelling and related data collection. This would support the work of the Expert Panel and help ensure that future investments by all levels of government are put to their best possible use.

To improve efforts to address housing supply, Budget 2019 proposes that Canada Mortgage and Housing Corporation invest $5 million over two years for state-of-the-art housing supply modelling and related data collection. This would support the work of the Expert Panel and help ensure that future investments by all levels of government are put to their best possible use.

The Government is committed to working in partnership with other jurisdictions in Canada that share concerns about the supply of affordable housing, and are willing to work together to find solutions.

Delivering on Canada's First National Housing Strategy

Every Canadian needs a safe and affordable place to call home. As more and more Canadians struggle with housing affordability, Canada's most vulnerable people are at greatest risk of experiencing inadequate housing and homelessness. This can include seniors, women and children fleeing domestic violence, Indigenous Peoples and persons with disabilities.

In 2017, to help more Canadians have access to housing that affordably meets their needs, the Government launched the National Housing Strategy, a 10-year, $40 billion plan that will build 100,000 new affordable housing units, repair 300,000 others, and reduce chronic homelessness by 50 per cent.

A 10-Year, $40 Billion Plan

Since announcing the Strategy:

- The new National Housing Co-Investment Fund has been launched, and is expected to help build 60,000 new units and repair or renew 240,000 existing units of affordable and community housing through contributions and low-cost loans.

- Seven provinces and territories have now signed bilateral agreements under the multilateral Housing Partnership Framework, which will see more than $7.7 billion in new federal funding flow to provinces and territories over the next decade to support the stock of community housing and address regional priorities.

In Budget 2019, the Government also proposes to introduce new legislation which will require the federal government to maintain a National Housing Strategy that prioritizes the housing needs of the most vulnerable, and will require regular reporting to Parliament on progress toward the Strategy's goals and outcomes.

National Housing Co-Investment Fund

Launched in May 2018, the Co-Investment Fund provides a mix of contributions and low-cost loans for the construction and repair of a range of affordable housing projects, including community housing, supportive and transitional housing, and shelters for survivors of domestic violence. To make federal investments go further, projects must also leverage support from other levels of government.

Construction of the New Maison de Lauberivière

Québec, Quebec

The Government of Canada is contributing almost $4.4 million towards the new Maison de Lauberivière, a 10,000-square-metre building which will have seven floors and feature 131 rooms for emergency and support services for homeless or vulnerable individuals, as well as 18 transitional housing units for people living with a mental health condition.

Building Safe and Affordable Housing

Hamilton, Ontario

The Government of Canada is contributing over $10 million towards the construction of 50 units at the YWCA Hamilton Ottawa Street Redevelopment. The Province of Ontario and the City of Hamilton are also partners in this project, which will provide safe and affordable housing for 35 women and women-led families, as well as another 15 units geared toward women with developmental disabilities.

Over the next year, important measures will be introduced to deliver on the Government's National Housing Strategy commitments. Reaching Home, a new $2.2 billion program to prevent and reduce homelessness, will launch on April 1, 2019—with the goal to reduce chronic homelessness by 50 per cent. Starting in 2020, a new, $4 billion Canada Housing Benefit will provide financial relief directly to those in core housing need and, over time, is expected to support 300,000 households. It is currently being co-developed with provinces and territories to ensure that the benefit is tailored to the diverse realities and needs across the country.

Working to Eliminate Homelessness in Greater Victoria

In 2018, the Government of Canada invested $30 million, as part of a $90 million partnership with the Province of British Columbia through BC Housing and Victoria's Capital Regional District, with the goal of eliminating chronic homelessness in the Greater Victoria Region. Funding was provided through CMHC's Affordable Housing Innovation Fund, and based on the most recent data, will result in enough housing units to help eliminate chronic homelessness in the region.

Increasing Fairness: Strengthening Rules and Compliance in Canada's Housing Market

The purchase of a home often represents the single largest investment individuals will make in their lifetimes. For this reason, it is critical that rules for buying or renting housing are applied equally across Canada's housing market, in a fair and transparent manner.

Taking Action to Enhance Tax Compliance in the Real Estate Sector

The Canada Revenue Agency (CRA) helps contribute to a healthy, competitive and stable Canadian housing market through its efforts to address tax non-compliance in real estate transactions.

Through the use of advanced risk assessment tools, analytics and third-party data, as well as collaboration with the provinces and territories to share information and access to data, the CRA is continuously enhancing its ability to detect, and take action whenever it finds, real estate transactions where parties have failed to pay the required taxes.

Recent efforts have uncovered more than $100 million of additional taxes assessed due to increasingly complex real estate transactions, which can only be addressed by auditors and business intelligence officers with specific knowledge, training, and expertise.

Budget 2019 proposes to provide the CRA with $50 million over five years, starting in 2019–20, to create four new dedicated residential and commercial real estate audit teams in high-risk regions, notably in British Columbia and Ontario. These teams will work to ensure that tax provisions regarding real estate are being followed, with a focus on ensuring that:

Budget 2019 proposes to provide the CRA with $50 million over five years, starting in 2019–20, to create four new dedicated residential and commercial real estate audit teams in high-risk regions, notably in British Columbia and Ontario. These teams will work to ensure that tax provisions regarding real estate are being followed, with a focus on ensuring that:

- Taxpayers report all sales of their principal residence on their tax returns;

- Any capital gain derived from a real estate sale, where the principal residence tax exemption does not apply, is identified as taxable;

- Money made on real estate flipping is reported as income;

- Commissions earned are reported as taxable income; and

- For Goods and Services Tax/Harmonized Sales Tax (GST/HST) purposes, builders of new residential properties remit the appropriate amount of tax to the CRA.

The expected revenue from this initiative is $68 million over five years, starting in 2019–20.

Deterring Financial Crime in Real Estate

The Government continues to work to deter financial crime, including mortgage fraud and money laundering in the real estate sector, through a strengthened enforcement framework, better outreach to and monitoring of private sector partners, and collaborative work among government leads. Federal, provincial and territorial governments are working together to make financial transactions related to corporate ownership more transparent, so that the true identities of parties involved in real estate transactions can be known.

To support this, the Financial Transactions and Reports Analysis Centre of Canada will continue to expand its outreach and examinations in the real estate sector, with a focus on the province of British Columbia, to improve detection of money laundering activities.

In addition, Canada has established a joint working group with the Province of British Columbia to examine issues related to tax fraud and money laundering in British Columbia and the Metro Vancouver region. The Government will continue to collaborate with its provincial and territorial partners to preserve the integrity and affordability of Canada's real estate market.

Monitoring Purchases of Canadian Real Estate

Together, tax non-compliance and money laundering can push up the cost of housing, making homeownership less affordable for middle class Canadians. To better fight these activities and protect fairness in Canada's real estate markets, federal enforcement agencies need access to good, high-quality data on foreign and domestic purchases of homes.

One way to do this is by working closely with other orders of government, including by using advancements in provincial and territorial records on real estate ownership to strengthen tax compliance. For example, British Columbia has recently enhanced its monitoring capabilities for real estate, including through the administration of its new speculation and vacancy tax. The data collected is shared with the Canada Revenue Agency, helping both British Columbia and Canada better administer their respective tax systems and Canada meet its information sharing obligations under international exchange of information relationships.

To improve monitoring of real estate purchases and ensure that information is shared in a timely manner, Budget 2019 proposes to provide Statistics Canada with up to $1 million over two years starting in 2019–20 to conduct a comprehensive federal data needs assessment. The assessment would seek to facilitate further streamlining of data sharing between federal and provincial governments to inform enforcement efforts on tax compliance and anti-money laundering.

To improve monitoring of real estate purchases and ensure that information is shared in a timely manner, Budget 2019 proposes to provide Statistics Canada with up to $1 million over two years starting in 2019–20 to conduct a comprehensive federal data needs assessment. The assessment would seek to facilitate further streamlining of data sharing between federal and provincial governments to inform enforcement efforts on tax compliance and anti-money laundering.

Results of the assessment would initially be used to inform the work of the British Columbia-Canada Working Group on Real Estate. The federal government is interested in working with other jurisdictions in Canada to jointly improve monitoring of real estate transactions across the country.

PART 2: A New Approach to Helping Middle Class Canadians Find and Keep Good Jobs

"To motivate both individuals and employers to significantly increase their investments in skills development, the government needs to deliver a jolt to the system by providing financial incentives, while also encouraging new training practices for all industries, all ages, and throughout the country."

Canada is a country whose economic success has always rested on the talent and creativity of its people. Well-educated, ambitious and hard-working, Canadians have what it takes to compete and succeed, even in an increasingly competitive global economy.

The challenge for Canada—and for Canadians—will be to find new ways to learn, and new ways to approach the changing world of work. This includes a rise in automation that challenges the very nature of work, with the Organisation for Economic Co-operation and Development (OECD) estimating that about one in ten Canadian jobs are at high risk of automation within the next 10 to 20 years, with about one in three jobs likely to experience significant change as a result of automation.

While past transitions suggest that the number of new jobs created will more than make up for those lost, this kind of change can be disruptive for many Canadians. It will be important to ensure that Canadians feel greater certainty in their skills and their ability to adapt to ongoing change.

Budget 2019 proposes new measures to support Canadians of all ages—as they enter the workforce and throughout their working lives.

Investing in Workers

Canadians work hard every day to take care of their families, support their communities and grow the economy. By investing in workers—giving them the tools and support they need for their continued success—the Government is helping workers find and keep good jobs today, and prepare for the new good jobs of tomorrow. These investments include:

Labour Market Development Agreements

These agreements between the federal government and the provincial and territorial governments help to deliver skills training and employment assistance to workers eligible for Employment Insurance (EI). This allows workers to access the help they need, when they need it most.

Investment: $1.8 billion over six years, announced in Budget 2017.

Workforce Development Agreements

- Introduced in 2017, these agreements provide support for Canadian workers who are not eligible for EI, including persons with disabilities, creating flexible opportunities to upgrade skills, gain work experience or start a business.

- Investment: $900 million over six years, announced in Budget 2017.

Skills Boost

A suite of measures announced in Budgets 2017 and 2018, these programs support Canadian workers who want to return to school and upgrade their skills, and include:

- Updated Canada Student Loans Program eligibility criteria to better assist part-time learners and low- and middle-income students with dependent children as they seek to retrain.

- Expanded Canada Student Grants to allow people who have been out of high school for at least 10 years to receive up to an additional $1,600 per school year ($200 per month) in top-up grant funding under a three-year pilot program.

- Revised Canada Student Grants eligibility criteria for participants to allow current income to be considered in their eligibility assessment, to better reflect the true economic circumstances of working or unemployed Canadians whose employment situation has changed significantly from the previous year.

- Changed EI eligibility rules to allow unemployed Canadians to enroll in full-time training without affecting their eligibility for EI benefits.

Investment: $575 million over four years, launched in the 2018-19 academic year and based on announcements in Budgets 2017 and 2018.

Future Skills

The Future Skills initiative will play a key role in ensuring that the Government is able to provide skills development programs that help Canadians prepare for the future of work by exploring major trends shaping the future and testing innovative approaches to prepare Canadians to meet them head-on.

Investment: $225 million over four years, with $75 million per year ongoing, announced in Budget 2017.

Horizontal Skills Review

The Government makes significant investments in skills development—close to $7.5 billion annually—across more than 100 distinct programs, ranging from programs for literacy and essential skills and apprenticeships, to those that assist newcomers to Canada in entering the labour market. Almost $3 billion of this programming is delivered in partnership with the provinces, territories and Indigenous groups, and targets students and Canadians who are unemployed.

In Budget 2018, the Government committed to a review of skills programming, to maximize its effectiveness, particularly the way in which support is provided to workers wishing to take advantage of emerging opportunities.

The review found that Canada has a robust suite of programs that support the development of key skills for Canadians—programs that encourage more people to work, including those who are traditionally underrepresented in the workforce, and those who face significant barriers to employment.

It also provided an opportunity to reflect on successes and determine where more can be done to help more Canadians find and keep good jobs. For instance, the review found that the current suite of programs is well-positioned to respond to the needs of post-secondary students, but that more can be done to provide all students the opportunity to gain valuable work experience, at home and abroad.

The review also recognized that there are a broad range of supports in place to help unemployed Canadians acquire and develop new skills, but that working adults in mid-career could benefit from more opportunities to refresh their skills, or gain new ones. This is consistent with what the Government has heard from other stakeholders, including the Government's Advisory Council on Economic Growth and Canada's Economic Strategy Tables, who have stressed the importance of investing in proactive retraining for working adults and encouraging everyone to embrace a culture of lifelong learning.

Following the Horizontal Review, the Government believes targeted changes could be made to help Canadians more easily navigate the programs and supports they need, improve the way that programs reflect the emerging skills needs in the labour market, and improve how programs show results so that decision-makers can better identify and invest in "what works."

Through Budget 2019, the Government is committed to making improvements that simplify access to programming so that more Canadians can benefit from existing supports, and to ensure that the skills people have are a good match with what employers need today—and in the future.

Improving Gender and Diversity Outcomes in Skills Programs

Budget 2019 provides $5.0 million over five years, starting in 2019–20, to Employment and Social Development Canada to develop a strategy and improve capacity to better measure, monitor and address gender disparity and promote access of under-represented groups across skills programming. This will build on work already underway to improve the quality and accessibility of labour market information, in partnership with Statistics Canada and the Labour Market Information Council.

Budget 2019 provides $5.0 million over five years, starting in 2019–20, to Employment and Social Development Canada to develop a strategy and improve capacity to better measure, monitor and address gender disparity and promote access of under-represented groups across skills programming. This will build on work already underway to improve the quality and accessibility of labour market information, in partnership with Statistics Canada and the Labour Market Information Council.

Introducing the Canada Training Benefit

For generations, middle class Canadians and those working hard to join them could be assured that with a good job came a good quality of life. Families were able to pay their bills, save for their retirement, and set aside money to give their kids a good education and a path to future success.

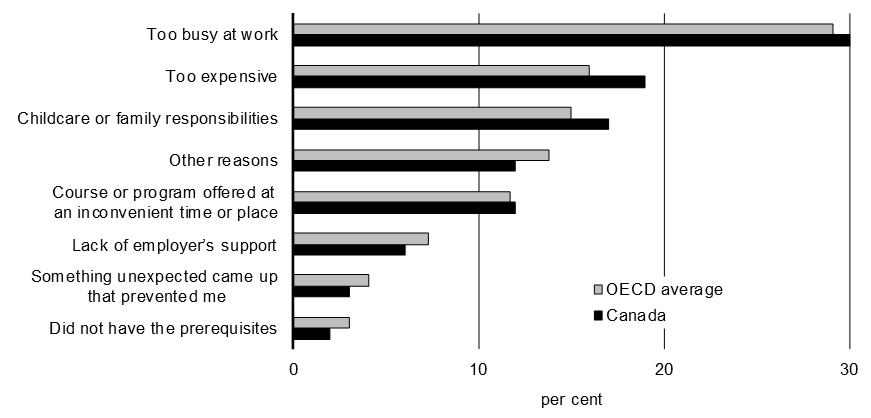

Today, the evolving nature of work means that people may change jobs many times over the course of their working lives or they may require new skills to adapt to changing roles. For working Canadians, this presents a new challenge: how to get the training they need to keep their existing jobs, or prepare for a new one.

Canadians who are already finding it difficult to make ends meet may find it tough to set aside money for additional training—even if that is what will give them the best chance at long-term success. Others, especially middle class Canadians with family responsibilities, struggle to find the time between work and family pressures to get new skills.

Canadians at all stages in their working lives should have the opportunity to invest in new skills, build greater job security and chart a better future for themselves and their families.

To help working Canadians get the skills they need to succeed in a changing world, Budget 2019 proposes to establish a new Canada Training Benefit—a personalized, portable training benefit to help people plan for and get the training they need. To deliver this new program, Budget 2019 proposes to invest more than $1.7 billion over five years, and $586.5 million per year ongoing.

To help working Canadians get the skills they need to succeed in a changing world, Budget 2019 proposes to establish a new Canada Training Benefit—a personalized, portable training benefit to help people plan for and get the training they need. To deliver this new program, Budget 2019 proposes to invest more than $1.7 billion over five years, and $586.5 million per year ongoing.

How the Canada Training Benefit Will Work

The Canada Training Benefit includes two key components—a new, non-taxable Canada Training Credit to help with the cost of training fees, and a new Employment Insurance (EI) Training Support Benefit to provide income support when an individual requires time to take off work. In addition, the Government intends to consult on changes to federal, provincial and territorial labour legislation to ensure that workers can take time away from work to pursue training without risk to their job security.

What the Canada Training Benefit Means for Workers

After four years, workers will have four weeks for training, up to $1,000 to help pay for the training, money to help cover living expenses, and the security of knowing they'll have a job to come back to when their training is done.

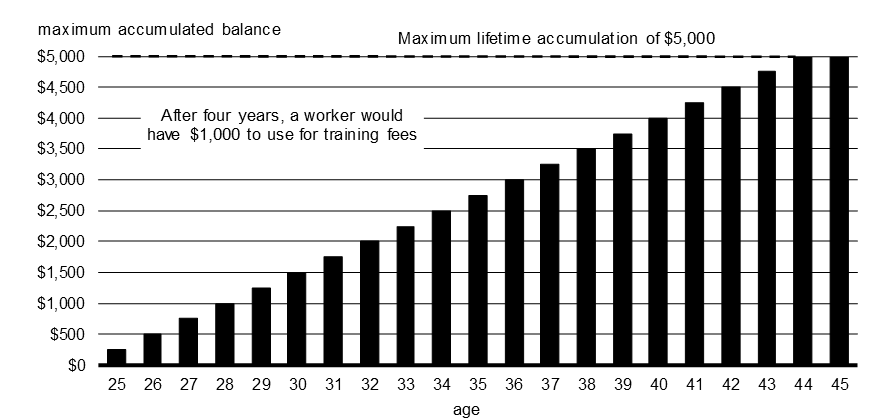

Canada Training Credit

- This new, non-taxable credit would help Canadians pay for training fees. Every year, eligible workers between the ages of 25 and 64 would accumulate a credit balance of $250 per year, up to a lifetime limit of $5,000. With this credit, a Canadian worker would accumulate $1,000 every four years, to be used for training fees.

- The accumulation of this refundable tax credit would be available to workers with earnings of at least $10,000 (including maternity and parental benefits) and income less than around $150,000 a year ($147,667 in the 2019 tax year).

- Canadians would be able to apply their accumulated Canada Training Credit balance against up to half the cost of training fees at colleges, universities, and eligible institutions providing occupational skills training starting in 2020.

- Canadians would claim this refund when they file their tax return. The updated credit balance would be included in the information the Canada Revenue Agency (CRA) sends to Canadians each year after they file their taxes. Canadians would also be able to check the total of their balance at any time, using CRA's My Account.

- To introduce and deliver this new credit, Budget 2019 proposes to invest $710 million over five years, starting in 2019–20, and $265 million per year ongoing.

EI Training Support Benefit

- This new benefit—expected to be launched in late 2020—would be available through the EI program and would provide up to four weeks of income support, every four years. This income support—paid at 55 per cent of a person's average weekly earnings—would help workers cover their living expenses, providing support for ongoing payments such as mortgage payments, electricity bills, and general life costs, while on training and without their regular paycheque.

- The new EI Training Support Benefit would provide workers with the flexibility to train when it works best for them, within a four-year period (for example, taking three weeks of paid leave in the first year, and the final week in the last year).

- To introduce and deliver this new benefit, Budget 2019 proposes to invest $1.04 billion over five years, starting in 2019–20, and $321.5 million per year ongoing.

Making the EI Training Support Benefit Work for Employers

- Improved access to training will mean that Canadian workers have the right skills to adapt and succeed in a changing economy, and are able to respond to the evolving needs of employers across Canada.

- At the same time, the Government recognizes that small businesses may worry about how the new EI Training Support Benefit may affect their bottom line in the short term. As a reflection of the Government's commitment to making this new benefit work for employers as well as workers, Budget 2019 proposes to introduce an EI Small Business Premium Rebate. Starting in 2020 any business that pays employer EI premiums equal to or less than $20,000 per year would be eligible for a rebate to offset the upward pressure on EI premiums resulting from the introduction of the new EI Training Support Benefit.

Leave Provisions

- Recognizing that many workers cannot afford to risk their employment while they pursue training, the Government proposes to consult with provinces and territories on changes to labour legislation to support new leave provisions.

- These new leave provisions would ensure that workers are entitled to leave and job protection while they are on training and receiving the EI Training Support Benefit. Employers, for their part, will benefit from motivated employees with upgraded skills, and small business will be protected against any increases in EI premiums.

In the coming months, the Government will consult with workers, employers, educational institutions and training providers, as well as provinces and territories, to finalize the design of the new EI Training Support Benefit and leave provisions.

How the Canada Training Benefit Will Help Workers and Employers

As a comprehensive collection of supports, the Canada Training Benefit targets the most pressing barriers to ongoing learning and retraining.

By cutting the direct costs of training by up to 50 per cent, workers can more easily save for—and benefit from—new training and new skills.

With income support through the EI program, workers won't have to choose between their training needs and their family's needs. Workers can take the time they need to invest in new skills, knowing that support is available to help them cover their living expenses.

With job protection through the leave provisions, workers will be able pursue training without worrying about losing their jobs.

And for employers, the benefits are also considerable. The Canada Training Benefit means workers with continually upgraded skills will be better able to help them—and Canada's economy as a whole—adapt and grow.

Canada Training Benefit by the Numbers

After four years, a typical Canadian worker will have:

- A $1,000 Canada Training Credit balance, which can be claimed fully against training and tuition fees of $2,000 or more.

- Up to four weeks of income support through the EI Training Support Benefit, paid at 55 per cent of average weekly earnings.

Using the Canada Training Benefit

Martin is a 37-year-old customer service representative working in a busy call centre. He earns $35,000 per year and likes his job, but knows that customer service is becoming increasingly automated. He is considering taking a five-week college course in human resources, to improve his chances of getting one of the shift manager jobs at his company.

After four years, Martin has accumulated $1,000 to his Canada Training Credit balance, and because he has been working full-time for several years, is eligible for the EI Training Support Benefit.

How Does the Canada Training Benefit Work for Martin?

Step 1: Prior to training

After confirming that the training institution he is interested in is eligible for the Canada Training Credit, Martin checks his balance through My Account, to make sure that he has the credit balance needed to take the next step. With that information confirmed, Martin discusses his training plan with his employer, letting them know that he'll need to take a leave to attend the course, offered by a local community college.

Step 2: Enrolling in training

Martin registers for the training course. He pays the full cost of registering for the course—$2,000—knowing that he will be able to claim the $1,000 Canada Training Credit when he files his taxes for the year.

Step 3: During training

Martin applies for the EI Training Support Benefit through Service Canada, to access his four weeks of benefits. Once his application is processed and eligibility is determined, Martin will start to receive up to 55 per cent of his average weekly earnings, via direct deposit.

Step 4: After training

After completing the course, Martin returns to work, bringing with him new skills that help him feel more confident about his work, and his future with his employer. Several months later, when he files his income tax return for the year, Martin claims the $2,000 he paid in tuition fees, and receives a $1,000 tax credit, drawn from his Canada Training Credit balance, which builds up again as Martin continues to work.

Overall, Martin will receive:

Canada Training Credit

EI Training Support Benefit (4 weeks)

Total support from the Canada Training Benefit:

$1,000

$1,481

$2,481

Preparing Young Canadians for Good Jobs

"Working together, we will find better ways to put the skills of young Canadians to work, and benefit from their contributions to a stronger economy and more equal society."

Young Canadians are more diverse, better educated and more socially connected than ever before. They have the curiosity needed to learn skills, and the ambition required to work hard and succeed.

At the same time, for too many families, the rising cost of post-secondary education has put the goal of attending college or university further out of reach. It can be difficult to save when children are young, and students who receive financial assistance often find it difficult to repay their loans.

To help the next generation of Canadian students get the education and training they need to do well and help grow our economy, Budget 2019 proposes a number of measures to make college and university education more affordable and accessible, and give young Canadians access to the work experience they need to find and keep good, well-paying jobs for years to come.

Affordable and Accessible Education

In the decades to come, young Canadians will be the ones who drive the future growth of Canada's economy. It's essential to our shared prosperity and continued quality of life that young people have access to high-quality education they can afford. For this reason, and because young Canadians deserve opportunities to grow, pursue meaningful careers and build rewarding lives of their own, the Government has taken decisive action to make post-secondary education more affordable for more young Canadians.

Helping With the High Cost of Post-Secondary Education

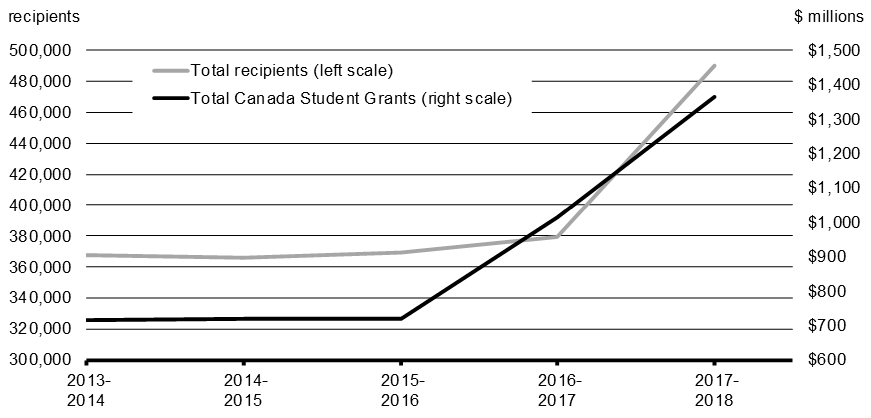

As an important first step toward helping young Canadians succeed, Budget 2016 used the savings realized from the elimination of the Education and Textbook Tax Credits to increase Canada Student Grants amounts by 50 per cent for students from low- and middle-income families. Budget 2016 also expanded Canada Student Grant eligibility criteria, making it possible for more students to receive non-repayable assistance.

Together, these changes helped more than 490,000 students receive an average of over $2,800 each in support from the Canada Student Grants program in the 2017-18 school year.

Looking ahead, Budget 2019 is doing even more to help make post-secondary education more affordable, and make student debt more manageable.

Making Canada Student Loans More Affordable

Despite the progress made since Budget 2016—which introduced changes so that no student has to repay their Canada Student Loans until they are earning at least $25,000 per year—many Canadian students still struggle to save for their education or repay student loans. This means difficult choices for many young people, who may leave school prematurely or put off life decisions like starting a family, or buying a home.

Lower Interest Rates

To help more students better manage the mounting pressure of higher living costs and the changing nature of work, and specifically to help make sure that student

loans are more affordable for the students who need them, Budget 2019 proposes the following changes to Canada Student Loans and Canada Apprentice Loans:

To help more students better manage the mounting pressure of higher living costs and the changing nature of work, and specifically to help make sure that student

loans are more affordable for the students who need them, Budget 2019 proposes the following changes to Canada Student Loans and Canada Apprentice Loans:

- Lower the floating interest rate—the rate chosen by approximately 99 per cent of Canada Student Loans borrowers—to prime, from its current rate of prime plus 2.5 percentage points, starting in 2019–20.

- Lower the fixed interest rate to prime plus 2.0 percentage points, from its current rate of prime plus 5.0 percentage points, starting in 2019–20.

New Interest-Free Grace Period

In addition, Budget 2019 proposes to amend the Canada Student Financial Assistance Act, so that student loans will not accumulate any interest during the six-month non–repayment period (the "grace period") after a student loan borrower leaves

school.

In addition, Budget 2019 proposes to amend the Canada Student Financial Assistance Act, so that student loans will not accumulate any interest during the six-month non–repayment period (the "grace period") after a student loan borrower leaves

school.

Lowering the interest rate and making the grace period interest-free will make post-secondary education more affordable and help students transition to the labour market successfully after leaving school. As a result of these changes the average borrower will save approximately $2,000 over the lifetime of their loan. Approximately 1 million student loan borrowers currently in repayment, and 200,000 graduates who leave school each year, will benefit from these changes.

Lowering the interest rate on Canada Student Loans and making the grace period interest-free will help approximately 1 million student loan borrowers currently in repayment, including Angela, who recently graduated from university with a bachelor's degree in psychology. After a five-month job search, she secured a position at a medium-sized consumer goods company. Budget 2019's proposal to make the grace period interest-free means Angela does not need to worry about accumulating further debt as she takes the time to transition from school to work. In addition, the new lower interest rate on Canada Student Loans will make Angela's $13,500 debt significantly easier to manage, saving her approximately $2,000 in interest payments over the 9.5-year repayment period for her loan.

Making Canada Student Loans More Accessible

The Canada Student Loans Program helps to make post-secondary education affordable for hundreds of thousands of students every year, but a small number of outdated program rules and restrictions make the Program less flexible and less accessible for some.

To better respond to the needs of vulnerable student loan borrowers, including those facing challenging life or financial circumstances, Budget 2019 proposes

to invest $15.0 million over five years, starting in 2019–20, to modernize the Canada Student Loans Program.

To better respond to the needs of vulnerable student loan borrowers, including those facing challenging life or financial circumstances, Budget 2019 proposes

to invest $15.0 million over five years, starting in 2019–20, to modernize the Canada Student Loans Program.

For student borrowers with disabilities, these changes would:

- Increase the cap on the Canada Student Grant for Services and Equipment for Students with Permanent Disabilities from $8,000 to $20,000 per year, to help students with permanent disabilities afford the necessary services and equipment for their studies.

- Expand eligibility for the Severe Permanent Disability Benefit so that more student borrowers with severe permanent disabilities can qualify for loan forgiveness.

- Make it easier for students with permanent disabilities to return to school after a long absence by removing the restriction that borrowers using the Repayment Assistance Plan for Borrowers with a Permanent Disability who have been out of study for five years cannot receive further loans and grants until their outstanding loans are paid in full, starting in 2020–21.

For student borrowers in other vulnerable financial or life situations, these changes would:

- Increase the eligibility for loan rehabilitation after a borrower defaults on their student loan, so that financially vulnerable borrowers in default can access supports such as the Repayment Assistance Plan and begin making affordable payments on their outstanding debt again.

Implement interest-free and payment-free leave in six-month stackable periods, for a maximum of 18 months, for borrowers taking temporary leave from their studies for medical or parental reasons, including mental health leave. Budget 2019 also proposes to increase compensation to provinces and territories—partners in the Canada Student Loans Program—by $20.0 million over five years, starting in 2019–20, with $4.0 million per

year ongoing. This increased funding will compensate provinces and territories for their costs stemming from Budget 2019's proposed changes to improve the accessibility of student financial assistance.

Implement interest-free and payment-free leave in six-month stackable periods, for a maximum of 18 months, for borrowers taking temporary leave from their studies for medical or parental reasons, including mental health leave. Budget 2019 also proposes to increase compensation to provinces and territories—partners in the Canada Student Loans Program—by $20.0 million over five years, starting in 2019–20, with $4.0 million per

year ongoing. This increased funding will compensate provinces and territories for their costs stemming from Budget 2019's proposed changes to improve the accessibility of student financial assistance.

Enhancing Supports for Apprenticeship

Skilled trades people are in high demand. These fields offer well-paid and valuable employment opportunities for those who wish to pursue them. To encourage people to explore careers in the skilled trades, the Government has made significant investments in apprenticeship programs that support a skilled, mobile and certified skilled trades workforce, and works closely with provincial/territorial partners and stakeholders to support high-quality apprenticeship systems across Canada. Many of these investments are now delivering results.

For example, through the Union Training and Innovation Program, launched in 2017, the Government is helping individuals get the training they need to succeed in the skilled trades, by supporting the purchase of up-to-date training equipment and innovative approaches to reduce barriers limiting apprenticeship outcomes. Since its launch, the program is helping Canadians by:

- Leveraging over $23 million in investments through cost-shared purchases of advanced training equipment and funding for innovative approaches to apprenticeship training.

- Targeting training supports to over 28,000 Canadians.

- Helping vulnerable Canadians—women, Indigenous Peoples, persons with disabilities and newcomers to Canada make up 40 per cent of project participants.

- Helping improve accessibility to training in remote communities through

e-learning platforms and mobile training units.

To encourage more young people to consider training and work in the skilled trades, the Government proposes to provide Skills Canada—a national organization dedicated

to encouraging young people to consider careers in the skilled trades and technology—with $40 million over four years, starting in 2020–21, and $10 million per year ongoing. This investment will enable Skills Canada to continue to encourage and support

a coordinated approach to promoting skilled trades and technologies to young people through skills competitions and by providing resources to better equip them for careers in the skilled trades.

To encourage more young people to consider training and work in the skilled trades, the Government proposes to provide Skills Canada—a national organization dedicated

to encouraging young people to consider careers in the skilled trades and technology—with $40 million over four years, starting in 2020–21, and $10 million per year ongoing. This investment will enable Skills Canada to continue to encourage and support

a coordinated approach to promoting skilled trades and technologies to young people through skills competitions and by providing resources to better equip them for careers in the skilled trades.

To bolster these efforts, the Government also proposes to invest $6 million over two years, starting in 2019–20, to create a national campaign to promote the

skilled trades as a first-choice career for young people. The campaign will work to change the perception around careers in the skilled trades, promoting their merits, including high demand, high wages, and continual professional development. In 2019,

the Government will appoint co-chairs to begin work on this campaign, lead initial consultations, and explore partnerships to assist with promotion of the skilled trades.

To bolster these efforts, the Government also proposes to invest $6 million over two years, starting in 2019–20, to create a national campaign to promote the

skilled trades as a first-choice career for young people. The campaign will work to change the perception around careers in the skilled trades, promoting their merits, including high demand, high wages, and continual professional development. In 2019,

the Government will appoint co-chairs to begin work on this campaign, lead initial consultations, and explore partnerships to assist with promotion of the skilled trades.

Budget 2019 also proposes to develop a new strategy to support apprentices and those employed in the skilled trades. This Apprenticeship Strategy will ensure that existing supports and programs—including the Apprenticeship Incentive and Completion Grants—address the barriers to entry and progression for those who want to work in the skilled trades in the most effective way, and support employers who face challenges in hiring and retaining apprentices.

Paid Parental Leave for Student Researchers

Budget 2018 provided historic new funding to reinvigorate Canada's research system, including the single largest investment in fundamental science in Canadian history. It also committed to ensuring that Canada's next generation of researchers—including students, trainees and early-career researchers—is more diverse.

To allow them to focus fully on their research, students receiving federal research grants or scholarships may not be participating in the traditional labour market. As there is no typical employer-employee relationship, student researchers are unable to take advantage of parental leave benefits offered under the Employment Insurance program.

To further improve equity, diversity and inclusion in the research system, Budget 2019 proposes to provide a total of $37.4 million over five years, starting

in 2019–20, and $8.6 million per year ongoing, to the federal granting councils, to expand parental leave coverage from six months to 12 months for students and postdoctoral fellows who receive granting council funding. This investment will help young researchers, especially women. It will also help parents better balance work obligations with family responsibilities, such as child care.

To further improve equity, diversity and inclusion in the research system, Budget 2019 proposes to provide a total of $37.4 million over five years, starting

in 2019–20, and $8.6 million per year ongoing, to the federal granting councils, to expand parental leave coverage from six months to 12 months for students and postdoctoral fellows who receive granting council funding. This investment will help young researchers, especially women. It will also help parents better balance work obligations with family responsibilities, such as child care.

Supporting Graduate Students Through Research Scholarships

In addition to student loans and grants, the Government offers a suite of scholarships that make higher education more accessible for students seeking to pursue graduate studies and develop the research skills needed in the knowledge-based economy. As the recipients of these scholarships train at universities and research hospitals and transition to the workforce, they bring new ideas and perspectives to tackle some of the worlds' biggest challenges.

To help more students access graduate studies, Budget 2019 proposes to provide $114 million over five years, starting in 2019–20, with $26.5 million per

year ongoing, to the federal granting councils—the Natural Sciences and Engineering Research Council, the Canadian Institutes of Health Research and the Social Sciences and Humanities Research Council—to create 500 more master's level scholarship

awards annually and 167 more three-year doctoral scholarship awards annually through the Canada Graduate Scholarship program.

To help more students access graduate studies, Budget 2019 proposes to provide $114 million over five years, starting in 2019–20, with $26.5 million per

year ongoing, to the federal granting councils—the Natural Sciences and Engineering Research Council, the Canadian Institutes of Health Research and the Social Sciences and Humanities Research Council—to create 500 more master's level scholarship

awards annually and 167 more three-year doctoral scholarship awards annually through the Canada Graduate Scholarship program.

In addition, starting in 2019–20, the federal government will work collaboratively with willing provincial and territorial partners on options to improve access to financial supports for graduate students from low-income families. Increased participation in post-secondary education will help vulnerable graduate students have higher earnings and get good-quality jobs, and helps the economy be more productive.

Supporting Indigenous Post-Secondary Education

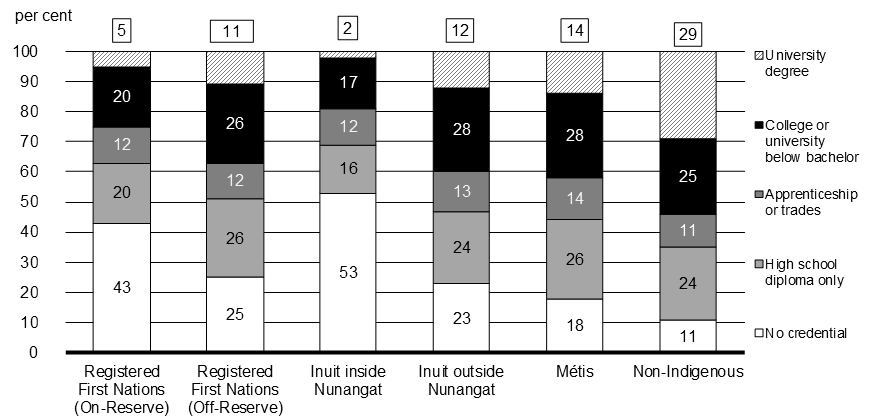

Indigenous Peoples are among the youngest and fastest-growing segments of the Canadian population, yet they continue to face barriers when it comes to pursuing post-secondary education and finding good, well-paying work. Engaging more Indigenous People in the workforce would boost economic outcomes for the nearly 1.5 million Indigenous Canadians as well as spur economic opportunities and raise living standards for all Canadians, potentially adding $7 billion to gross domestic product. More than two-thirds of Canadian jobs from now to 2024 are expected to require some form of post-secondary education, yet Indigenous Peoples are less likely to access and complete post-secondary education. Indigenous Peoples in the core working population are, on average, 18 percentage points less likely than their non-Indigenous counterparts to hold a university certificate, diploma or degree at the bachelor level or above.

The proposed investments in Budget 2019 will help Indigenous Peoples obtain the skills and experiences they need to succeed in a changing economy and contribute to stronger economic growth for all Canadians.Chart 1.5 Educational Attainment by Indigenous Identity

Budget 2019 proposes a number of investments, starting in 2019–20, to ensure that Indigenous students have better access to post-secondary education, and more

support to ensure that they can succeed during their studies. This includes support for:

Budget 2019 proposes a number of investments, starting in 2019–20, to ensure that Indigenous students have better access to post-secondary education, and more

support to ensure that they can succeed during their studies. This includes support for:

- First Nations communities by investing $327.5 million over five years to renew and expand funding for the Post-Secondary Student Support Program while the Government engages with First Nations on the development of long-term First Nations-led post-secondary education models.

- An Inuit-led post-secondary education strategy through an investment of $125.5 million over ten years, and $21.8 million per year ongoing.

- A Métis Nation-led post-secondary education strategy consisting of financial assistance for Métis Nations students through an investment of $362.0 million over ten years, and $40.0 million per year ongoing.

To further support Indigenous students, Budget 2019 proposes to provide Indspire with $9.0 million over three years, starting in 2019–20, for additional bursaries

and scholarships for First Nations, Inuit and Métis students. Indspire is an Indigenous-led registered charitable organization with a proven track record of helping Indigenous students attend post-secondary institutions and find good jobs.

To further support Indigenous students, Budget 2019 proposes to provide Indspire with $9.0 million over three years, starting in 2019–20, for additional bursaries

and scholarships for First Nations, Inuit and Métis students. Indspire is an Indigenous-led registered charitable organization with a proven track record of helping Indigenous students attend post-secondary institutions and find good jobs.

Finally, to help Indigenous students access the full range of available student supports, including financial assistance programs such as Canada Student Grants, the Government will engage Indigenous Peoples to ensure that these programs are working for them.

Skills for Canada and the World

Young people recognize that not all skills are learned in the classroom. Increasingly, students and recent graduates are taking advantage of co-op programs and other experiential learning opportunities—such as work placements with local employers or service opportunities within their communities—as a way to further what they have learned in school while earning valuable work experience. The Government supports this comprehensive approach to learning and is investing to help more young people get the skills that will make Canada—and the world—a better place.

Expanding the Canada Service Corps

Service opportunities give young Canadians the chance to gain valuable work and life experience, build on what they've learned through their formal education, and give back to their communities in meaningful ways.

To encourage and support more service, in January 2018, the Government launched the design phase of the Canada Service Corps, a youth service initiative. Since that time, the Government has been meeting with and listening to young people—from across the country and from different backgrounds and circumstances—to better understand what service means to them.

Like young people, the Government believes that every young person who wants to build a better Canada through volunteer service should have the opportunity to do so.

Based on the extensive consultations and feedback received to date, Budget 2019 proposes to invest up to an additional $314.8 million over five years, starting

in 2019–20, with $83.8 million per year ongoing, to make the Canada Service Corps Canada's signature national youth service program. This investment will support:

Based on the extensive consultations and feedback received to date, Budget 2019 proposes to invest up to an additional $314.8 million over five years, starting

in 2019–20, with $83.8 million per year ongoing, to make the Canada Service Corps Canada's signature national youth service program. This investment will support:

Kayla has just graduated from high school and hopes to complete a service experience related to her passion for environmental protection before pursuing post-secondary studies. Budget 2019's new funding for the Canada Service Corps (CSC) means Kayla can use the Youth Digital Gateway to find an experience that is both relevant to her interests and flexible enough to align with her schedule.

Over the next six months, Kayla completes a CSC-sponsored service placement related to ocean conservation that allows her to contribute to her community and improves her ability to speak in public and work collaboratively, leading a small team of her peers. This placement inspires Kayla to continue volunteering with environmental organizations and provides her with skills and experience that will aid her in her studies and subsequent job search.

- Up to 15,000 annual volunteer service placements with national, regional and local partner organizations by 2023–24.

- 1,000 annual individual grants for self-directed service projects.

- New incentives and program supports co-created with young people to address barriers to participation in volunteer service programs.

- A new digital platform—seamlessly integrated with the Government's new Youth Digital Gateway, an online, user–friendly platform to help youth access federal supports— that allows young people to identify, manage and share experiences from their service placements.

Giving Young Canadians Digital Skills

Canadians are living and working in an increasingly digital world. With more opportunities to acquire and develop digital skills, young Canadians—from kindergarten to grade 12—will have a head start in building the skills they will need to find and keep good, in-demand jobs. The CanCode program helps young people get these coding and digital skills, with training support for their teachers and a special focus on reaching young people who are traditionally underrepresented in Science, Technology, Engineering and Mathematics, such as girls and Indigenous youth. In its first two years, CanCode has provided more than 800,000 K-12 students and about 40,000 teachers with the chance to learn these important skills.

To give even more young people opportunities to get the digital skills that will help them succeed, Budget 2019 proposes to provide $60 million over

two years, starting in 2019–20, to support CanCode's ongoing work and help one million more young Canadians gain new digital skills.

To give even more young people opportunities to get the digital skills that will help them succeed, Budget 2019 proposes to provide $60 million over

two years, starting in 2019–20, to support CanCode's ongoing work and help one million more young Canadians gain new digital skills.

Modernizing the Youth Employment Strategy

Young Canadians are talented, ambitious and hard-working, but making the transitions from school to the workforce can be challenging for many—especially for vulnerable youth who face additional barriers to success, such as low-income youth, Indigenous youth, racialized youth and youth with disabilities.

Since 1997, the Youth Employment Strategy has helped young people make the transition from school to work, and get a strong start in their careers. At the same time, as noted by the Expert Panel on Youth Employment, the Strategy is in need of an update, to ensure that it is able to continue to meet the needs of young people in the future.

Budget 2019 proposes to invest an additional $49.5 million over five years, starting in 2019–20, to launch a modernized Youth Employment Strategy informed

by the recommendations of the Expert Panel on Youth Employment and extensive engagement with youth, service delivery organizations and other stakeholders.

Budget 2019 proposes to invest an additional $49.5 million over five years, starting in 2019–20, to launch a modernized Youth Employment Strategy informed